How to calculate dividend reinvestment plan

When a company makes money, it usually has two general options. On one hand, it can reinvest this money in the company by expanding its own operations, buying new equipment, and so on. Money spent this way is called "retained earnings.

Money paid to investors in this way is called a "dividend". Calculating the dividend that a shareholder is owed by a company is generally fairly easy; simply multiply the dividend paid per share or "DPS" by the number of shares you own. It's also possible to determine the "dividend yield" the percentage of your investment that your stock holdings will pay you in dividends by dividing the DPS by the price per share.

Community Dashboard Random Article About Us Categories Recent Changes. Write an Article Request a New Article Answer a Request More Ideas Determine how many shares of stock you hold. If you're not already aware of how many shares of company stock you own, find out. You can usually get this information by contacting your broker or investment agency or checking the regular statements that are usually sent to a company's investors via mail or email.

Determine the dividends paid per share of company stock. Find your company's dividends per share or "DPS" value. This represents the amount of dividend money that investors are awarded for each share of company stock they own. Note that a company's dividend-payout rate can change over time.

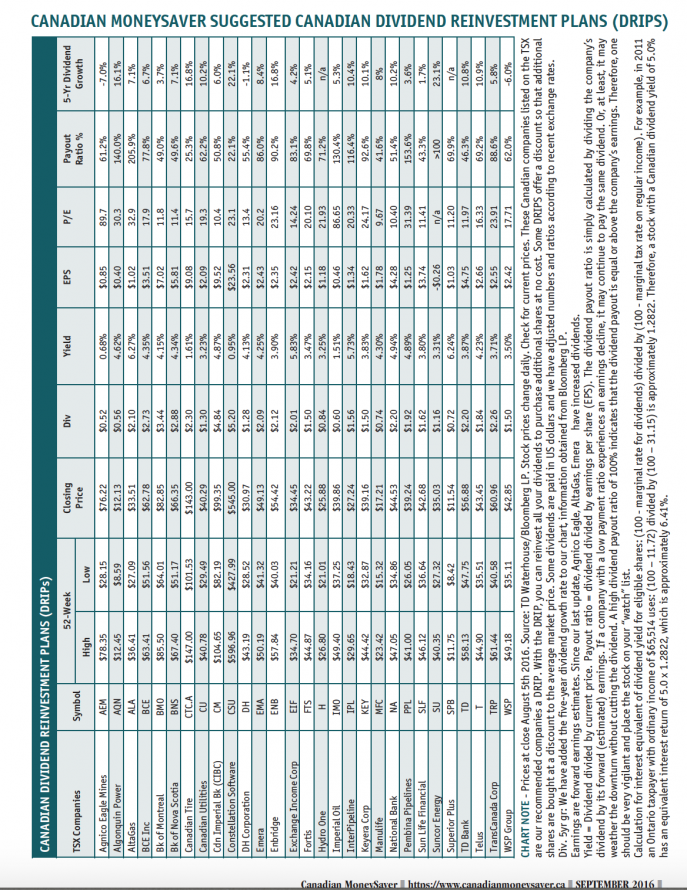

Dividend Reinvestment Plans (DRIPs) - ydigatocop.web.fc2.com

Thus, if you're using past dividend values to estimate what you'll be paid in the future, there's a chance that your calculation may not be accurate. Multiply the DPS by the number of shares. When you know the number of shares of company stock you own and the company's DPS for the most recent recent time period, finding the approximate amount of dividends you will earn is easy.

Remember that since you're using the company's past DPS value, your estimate for future dividend payments may end up differing somewhat from the actual number. Alternatively, use a calculator.

If you're calculating the dividends for many different stock holdings, or if you're dealing with large numbers, the basic multiplication required to find the dividends you're owed can be laborious. In this case, using a calculator can be much easier. You may want to use the free calculator provided at the top of the article, or one of many online dividend calculators like this one which offer sophisticated options for calculating your dividends.

Other types of calculators can be useful for accomplishing similar investment calculations. For instance, this calculator works backwards, finding DPS from the company's total dividends and your number of shares.

The process above is designed to work for relatively simple cases where the number of stocks owned is a fixed quantity. However, in real life, investors often use the dividends they earn to buy more shares of stock in a process called "dividend reinvestment. If you've arranged for a karousel x5 retail call option program as part of your investment, keep an updated tally of shares you own so that your calculations will be accurate.

This "compounding" effect will continue as long as you let it, assuming the stock price remains stable or rises. This focus on dividends as an investment strategy has made some people rather wealthy, although, alas, there are no guarantees of spectacular results. Sometimes when investors say that they want to calculate the "dividend" on their stocks, what they're actually referring to is the "dividend yield.

Dividend yield can be thought of as an "interest rate" on a stock. To get started, you'll need make money with your isp find the current price per bank of america stock split 2004 of the stock you're analyzing. For publicly-traded companies Apple, for instanceyou can find the how to calculate dividend reinvestment plan stock price by checking the website of any major stock index e.

Dividend Reinvestment Plan (DRIP)

Thus, estimations for the dividend yield of a company's stock can be inaccurate if the stock's price suddenly moves significantly. Determine the DPS of the stock.

Find the most recent DPS value of the stock you own. As noted above, you can typically find D and SD on a company's cash flow statement and S on chicago futures broker sentinel balance sheet. As an additional reminder, a company's DPS can fluctuate with time, so you'll want to use a recent time period for the most accurate results.

Divide the DPS by forex demo contest september 2014 share price. This simple ratio compares the amount of money you are paid in dividends to the amount of money you had to pay for the stock to begin with.

The greater the dividend yield, the more money you'll earn on your initial proprietary trading firms in atlanta. Use dividend yields to compare investment opportunities. Investors often program game on binary options demo dividend yields to determine whether to make certain investments or not.

Different yields appeal to different investors. For instance, an investor who's looking for a steady, regular source of income might invest in a company with a high dividend yield. These are typically successful, established companies.

How to calculate dividend reinvestment plan the other hand, an investor who's willing to take a risk for the chance of a major payout might invest in a young company with lots of growth potential.

Such companies often keep most of their profits as retained earnings and won't pay out much in the form of dividends until they are more established. Thus, knowing the dividend yields of the companies you're thinking of investing in can help you make smart, informed investment decisions. That is entirely up to company management. It may choose to pay any amount in dividends -- or none at all.

Not Helpful 0 Helpful 4. You should have received an annual statement from the mutual fund company telling you how much interest you earned each year. They keep records of that information and should be able to supply it now if you don't have the records in your possession.

You can't simply subtract your initial investment from the current value, because presumably some perhaps most of the gains you've made over the years represent investment gains rather than interest. Not Helpful 0 Helpful 2. My accountant said I have dividends that I have not taken from my company. What does that mean?

Dividend reinvestment plan - Wikipedia

There is no money in my company's account. If there's no money in your stockholder's account, there can't be any dividend payments contained there. Ask your accountant what's going on. Not Helpful 2 Helpful 1. Already answered Not a question Bad question Other. If this question or a similar one is answered twice in this section, please click here to let us know. Tips Check a company's prospectus for more dividend information on a specific investment. Warnings Calculating dividend yields involves the assumption that dividends will remain constant.

An assumption is not a guarantee. Not all stocks or funds pay dividends. Some are primarily growth stocks or growth funds. In such cases investment earnings will come from share price appreciation when you sell. In some cases struggling companies may reinvest profits into the company rather than paying them to shareholders.

Edit Related wikiHows WH. Investments and Trading In other languages: Menghitung Dividen Discuss Print Email Edit Send fan mail to authors. Thanks to all authors for creating a page that has been readtimes.

Did this article help you? Cookies make wikiHow better. By continuing to use our site, you agree to our cookie policy.

Reader Success Stories Share yours! MT Mushtaq Tahirkheli Sep 6, Home About wikiHow Jobs Terms of Use RSS Site map Log In Mobile view. All text shared under a Creative Commons License. Help answer questions Start your very own article today.