Auto futures trading

Day trading or swing trading commodity futures can be a very profitable business. Unfortunately there are so many different commodities that it is impossible to actively monitor and trade all of them. One is to research and test all candidate commodities and select the two or three best ones for active trading. This should probably be done in any case as margin requirements for commodity futures trading can be quite hefty.

Another problem that affects day traders primarily is the fact that sometimes trades set up and trigger very quickly and unless you have the reflexes of a Ninja you will miss many a profitable trade. That is the dream for many traders, that their computer can be programmed to do the trading for them. But can it really be done?

Automated Futures System Trading

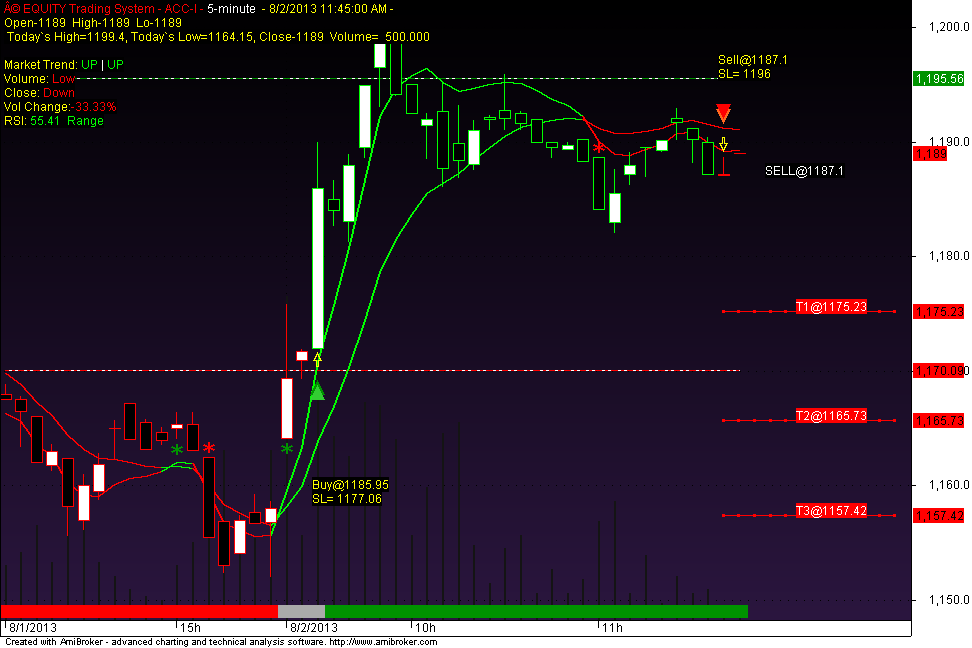

An automated trading system needs to do several things:. The first two are fairly straightforward. You can search the internet and find thousands of results for systems that claim to do just that. Figure 1 shows an example of a system with proven, in the market results, the Premier Trader University TrendJumper Pro. Exactly how the automation takes place and what constraints are placed on it will of course depend on the automation software. Two popular charting packages that provide automation capabilities are NinjaTrader and TradeStation.

Both can identify the initial setups and both can track stops as they are adjusted. These are just representative examples and many more will depend on the specifics of the strategy and instrument being traded.

When these happen synchronization can be forced by cancelling the setup in the software or getting in synch at the original entry price where possible. In the case where the software has not exited a trade in time it can simply market out.

These situations will occur on occasion however and the trader has to be aware that not all trades will execute as expected. Slow or overburdened connections are difficult to overcome and the trader must seek a better technical solution, a different internet provider perhaps. There is simply no way to synchronize if the computer cannot speak to the trade server. The only remedy available to the trader in that case, short of a backup internet connection, is a telephone call to the broker.

The systems we just described provide complete trade automation, from initial setup and execution, through the position and stop management and until the final closing of the position. There are other scenarios where automation is combined with manual trade execution that can be appealing to the trader. The computer uses automation to enter the trade, but once entered the trader manages the stop and exits manually.

This is an attractive option for trading instruments that can move too fast for the trader to enter manually.

The trader then uses his discretion to manage the trade as best fits the evolving market action. The trader enters the trade manually but the computer manages the stops and exits via automation. This is a great option for traders who like to scan a large number of instruments waiting for a specific setup, then jump on those setups.

AlgoTrades - Algorithmic Trading Strategies - Algo Trading - Futures Trading System - Trading Algorithms - Automated Trading Systems - Quantitative Trading Strategies

The automated trade management software then allows the trader to continue to monitor the markets for additional opportunities while the computer manages the open positions. The risks here are exactly the same as above, although the risk of losing synchronization is greatly reduced since only half of the trade management is left over to the computer. The danger of a lost connection of course is still the major concern and the solution here too may be a call to the broker to exit any open positions.

Finally, any automated trading system must also know when not to trade.

Auto-Trade Futures Trading Systems | BTR Futures

Although we may be tempted to leave the computer running and trading around the clock this can be a recipe for failure. This can be based on the time of day and day of the week, on scheduled news events or on daily trading results.

For example the system should only trade for one hour starting at the time the equities markets open, or it should only trade until a certain profit objective is achieved or a loss threshold is reached. The software platform should also provide the trader with an easy way to turn the automation on or off manually.

We may not have to stare at the screen constantly but we need to be able to scan open positions and match them against the actual position at the brokers. Free Trading Software, Based on Trends, Requires No Specific Broker or Platform! About Us Testimonials Staff Contact Us. Counter Punch Trader Dynamic Swing Trader Options Fast Track Options Academy NetPicks Trend Jumper. Forex Trading Futures Trading — The Complete Guide Why You Should Choose Options Trading Swing Trading Tutorial Day Trading ETF Investing.

Informer Newsletter Trading Tips Blog Trading Videos NetPicks Training Webinars. Counter Punch Trader NetPicks Options Fast Track NetPicks ETF Investor Dynamic Swing Trader Netpicks Live Signal Service Forex 1, 2, 3 Brick Charts Advanced.

There are a couple of solutions to this problem.

Automated Trading Systems Do The Heavy Lifting That is the dream for many traders, that their computer can be programmed to do the trading for them. The short answer is yes, but with cautions. An automated trading system needs to do several things: Figure 1 — PTU TrendJumper Pro Exactly how the automation takes place and what constraints are placed on it will of course depend on the automation software.

Automated Futures Trading Systems

Any limitations are normally due to limitations in the coding of the strategies. Lost internet connections however are the gravest problem. This may not be possible depending on your platform and on the way the automation is programmed.

Manual And Automation Combined The systems we just described provide complete trade automation, from initial setup and execution, through the position and stop management and until the final closing of the position.

Automation Takes A Trading Break Finally, any automated trading system must also know when not to trade.

An automated trading system must therefore also know when not to trade. So can it be done, can the computer trade for us? The answer as you see is a conditional yes. Do that and let the computer do the hard work of managing the actual trading. Dynamic Profit Generator Free Trading Software, Based on Trends, Requires No Specific Broker or Platform!

Forex Trading Futures Trading Options Trading Day Trading Swing Trading About Us Our Staff Contact Us Our Products Testimonials Member Area Take The Quiz Trading Tips Premier Trader University Forex Trading Systems Futures Trading Systems Options Trading Systems Swing Trading Systems Day Trading Strategies.

NetPicks LLC Lohmans Crossing Road Suite Lakeway TX For Inquiry GET FREE Trading tips, trick, techniques and lessons Join our newsletter. Here is the website link: Send Me The PDF Version! We hate spam and promise to keep your email address safe.