Ibig sabihin ng stock market

Last Updated June 21, By Fehl Dungo Comments. This means their stock prices are below their fair market value that is why we recommend buying these stocks while they are on this status. Take note of the bullish market or the opposite bear, too. Always consider the trends in the market and contemplate about the economic status in choosing stocks. Be extra cautious of flipping non-blue-chip companies.

I recommend to prioritize blue chip if they are on the list. We also included the BBP Buy Below Price so that we have a margin to gain more profit investing with these stocks. We sell our stocks when they reached our Target Price. If your strategy is passive and long term investing, you can also follow our style here. We are into INVESTING than TRADING. The term STOCKS remind us of aggressiveness and risks already so we prefer investing undervalued stocks and flipping over the profit to buy other deserving stocks.

We made this special page for our loyal readers and followers. If there are some companies we have missed that are worth buying, please let us know in the comments.

We are all in this together. Following Magic 10 is different compared to flipping these stocks to make profit. Stocks Price today Buy Below Price Target Price Estimated Growth Action ABS Prices change every millisecond. Details on the table above can change any time. We always update the details above when there are adjusted valuations and we also add more stocks. Feel free to bookmark or visit this page again to check any change and update.

In short, the higher the percentage there, the more room for growth of the stock. If you are only starting to invest, it is recommended you buy the stocks with the highest Estimated Growth.

You can sort the column above the way you want to. Investing stocks have risks. Nothing and nobody can predict exact result or outcome of profit. However, it has been proven rewarding. Stock MarketStock Update. This blogsite shares tips, guides, and strategies about making money from stocks and equities. Feel free to share yours in the comments. Connect with me on Facebook and Instagram. June 20, at June 16, at 3: Hi Fehl, I just want to say thank you so much for this list.

I bought IMI at P5. This was really a big help for me. Thank you so much for sharing your predictions and knowledge of handling stocks. You are really a great help to all of us!

God bless you more! June 13, at 3: June 15, at 9: FGEN did not meet expectations so soon. You better wait to gain some then sell all shares if you speculate other worthy stocks.

June 15, at I bought it at 5. I appreciate a reply from you. June 5, at Jeremiah Juan de Jesus says. What are you thoughts about MEG? Di pa nareach ung TP nya tapos bigla bumulusok ngayon at 4. Is it because of its upcoming dividends?

Do I need to sell it now to lock in my profits? Already sold it as I was nervous that it would fall again, lol. Would just to buy others stocks for now.

It juts hit the Trillion cap! Will be making a post about it here. June 2, at 3: June 3, at June 4, at 9: June 1, at 6: Did you just add ABS here recently? Or it has been here for a while and just did not notice it? June 2, at June 6, at June 10, at 3: I just bought some EDC stocks for flipping. I missed what you said which is to not prioritize FGEN and EDC due to indefinite long term development pipeline. June 1, at Just want to ask how is Philweb still in the market even though the company itself is already closed?

Who is responsible for all its stock? May 31, at 3: May 31, at 4: May 30, at 6: I noticed a significant dropped just recently for these giant companies.

Is it because of the supply shortages the industry are facing now? I also heard of the impending shutdown of the natural gas producing Malampaya in I think most of the stocks right now are not cheap. You can still buy on FGEN and EDC but do not prioritize them because the power sector has no clear long term development pipeline.

May 26, at 2: Hi Fehl, may I just ask, how come MPI an undervalued stocks keeps on going down? May 31, at 2: You can keep this stock and wait for your gains.

May 23, at 9: Fel, both FPH and FGEN are still not moving for like the longest time. Are they still viable for investment? Most of my money is invested on them and I feel that it took too long to even break even still on the negative: May 24, at 9: FGEN did not meet expectations but I think it is still undervalued.

FPH, like any other Conglomerates is facing idle time. May 31, at 1: Thank you miss Feihl for including chp on your list i was able to buy a lot when it was way down. May 26, at 9: The estimated time to reach the target value is almost a year. I have a subscription to an online broker.

May 23, at Is it ok to sell or wait to reach the 27 to 28 mark? May 8, at May 19, at 7: Yup, I also sold my entire IMI 9. Still holding on to it. Keeps on going up. June 8, at 4: May 7, at 8: May I know your thoughts on investing MRSGI, CHP and FGEN? Is it okay for long term or short term? May 5, at 9: May 4, at May 4, at 1: Been reading some positive news regarding the company of late… Thank you Ms.

You are a big help to us newbies. May 6, at 5: May 9, at May 10, at May 3, at 4: Can you share some thoughts about MRSGI? Is it undervalued too and does the company have a good fundamental? May 2, at 2: Their stocks are on a downward trend starting last week. ABS is a non-blue-chip so before you flip such stocks, you must always be more cautious.

So I think they are into solving it now. May 3, at 3: I am losing Do you suggest that we keep buying more while it is on a downward trend?

May 12, at 3: Suggest you buy MER instead, Meralco also give dividends. Those are only unrealized loss for now. By my experience this might be time to worry, but not to panic, instead rethink your strategy, even buy at this price and look for goldmines like 2go and others.

May 2, at 1: Considering yung threat ni Duterte and yung biglang pagbaba ng ABS stock currently April 26, at 1: Adrian A Dela Cruz says. April 2, at I Just opened my account with COL and I just want to seek your advice as to what are the stocks you would recommend to buy for long term investing using peso cost averaging strategy.

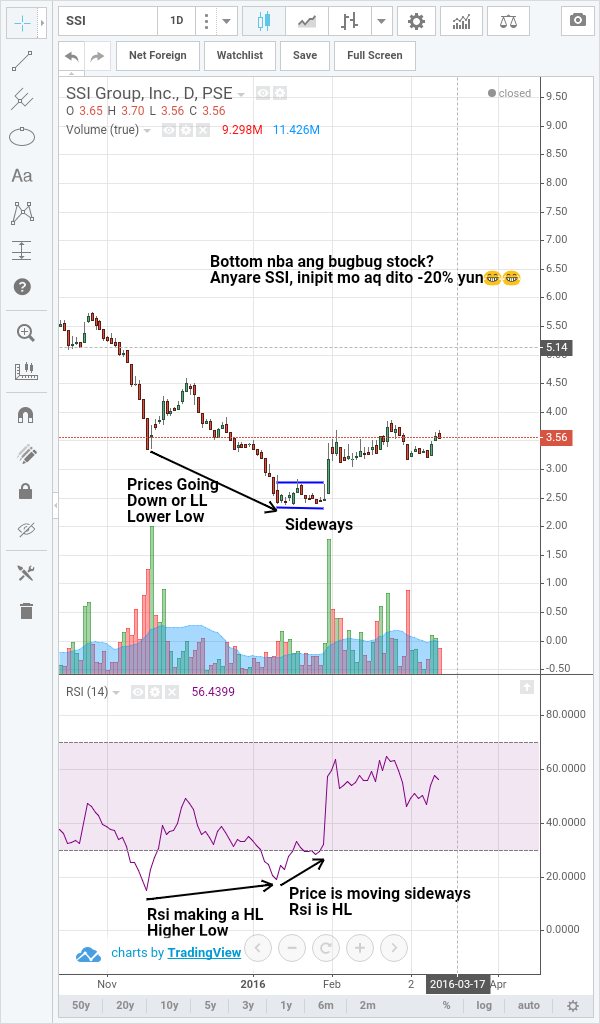

I am planning buy to 3 to 5 stocks. Hoping for your response. Thanks po and more power! March 29, at 5: Hi Ms Fehl, ano nangyari mam sa SSI bat pababa ng pababa? March 28, at 9: Gaano katagal sa tingin niyo bago umakyat ulit ung price ng FPH? March 16, at 3: March 21, at 1: March 24, at March 15, at 9: March 27, at 8: March 14, at March 13, at 4: March 10, at 9: Hi Ms Fehl What do you think about X … I checked its chart and it seems to have built strong support at 7.

March 2, at 9: March 10, at 3: February 23, at 7: Fel usually 6 to 12 months ba pag flipping stocks? If ever din ba nagka profit ako sa portfolio pwede ko ba increase monthly investment like for example, a month sa cost averaging?

February 20, at Just want to ask your view on FPH stocks. February 23, at 2: February 27, at 3: Cant get into trading BDO nomura.

February 8, at 5: February 7, at 8: February 5, at 5: May bago po ba tayong list o mga karagdagang company na undervalued? Halos karamihan kase eh nasa stage na ng stop buying.

May mga new entries po ba? So far wala pa because no significant reason to add some pa. Just check nalang everyday. We could add some anytime when they are favorable. January 24, at 1: January 11, at 9: Do you think VLL will reach its TP this year? Would really appreciate your advise. January 25, at 5: January 11, at 8: Hi Fehl, Im just a newbie investor.

Ask ko lng po ano ibig sabihin ng stock rights offering? Ano po ang advantages at disadvantages sa investor. Stock rights are offered to existing stockholders of that company who issue the stocks rights. I recommend buying if the company is a good one and if SRO is reasonable for business growth.

You can read our explanation for stocks rights here: December 21, at Bakit po kaya biglang bumaba ang BBP and TP ng SSI? Does it mean po ba na bumabagsak na siya? December 17, at 2: December 21, at 9: December 16, at 9: December 16, at 4: Why do I see some values like FPH and EDC with Target Prices that have never been reached before? What is the time frame of the estimated growth? Is it a bit long term because of the high target prices? Pardon me for sounding so critical.

Sometimes when I get analytical, I have that tone. Above stocks are just for flipping and not for long term, but some analysts from other sites also made some forecast for a 12month period target price like EDC to 9. December 22, at 2: Will dig further about stocks flipping. December 4, at 7: Hi Fehl, I plan to start putting aside 5k a month starting on January.

I want to a portfolio for long term and flipping. I am a beginner. I will increase it to 10 or 15k month on December 5, at 2: Do your own due diligence on listed companies by looking at the ff: So that any advise given to you by others you will be better equipped and according to business that you can easily understand or is closer to you ex.

Products that we use or could not live without. December 5, at 8: I dont have time for due diligence I am 60 plus and the sun is setting. December 5, at 4: Here is my suggestion for your long term portfolio: MBT — for banking ALI — real estate URC — consumer.

November 28, at 1: Hello Fehl, I just started investing in the PSE last week. I am an American and invest in the American exchanges and finally decided to open in account here. It took longer than expected but that was good because this is great time to make an entry.

While waiting to get my brokerage account open I read a lot of your articles on investing and they were very useful and informative. Your advice is sound. I was surprised to learn one half of one percent of Filipinos invest in the market! This updated list above is helpful. I bought CEB which is on the list. I also bought some ALI for a good price.

I was thinking about getting pure gold which is on the list. I was wondering if you had any thoughts on Manila electric MER? The stock is trading very low. It has a decent dividend. I was thinking more along the lines of an income stock for MER and not so much flipping it.

Last what do you think about jolibees now? It dropped a lot the past month and I was thinking about buying some shares, but I did not see it on the list. Thanks for all your all your articles on here and Philpad. December 1, at I do my best to keep them updated. Trying to help fellow Filipinos for free spreading out financial tips here. MER is a great company as well. You can check out the BBP for it at this page: JFC is among the Big 5 stocks I recommend for investing and applying PCA method.

JFC is listed on the PSEI, one the best bluechips, has decent return every year. JFC is also adding more branches nationwide and is also opening its doors internationally. You can find those pages on the Stocks Menu above. April 9, at 6: June 4, at 2: November 27, at 6: My average price is November 29, at 1: December 2, at Relax guys we all experiencing actually is the opportunity to buy while stock market is down.

All my green stock become read. December 2, at 8: November 15, at 1: All my stocks are in the red, except for IMI. Parang medyo malaki ang naging effect ng political uncertainty sa bansa regarding the policies of the new president. I hope that things would turn around medyo masakit na yung losses ko.

November 16, at 7: Same here, sana the situation will be temporary only, my stocks are all below the market value. Hope this will just be a paper loss and rebound back soon. November 14, at At the moment Temper Agressiveness, and look for bargain or stocks which are way below market value.

November 12, at 7: What do you suggest para makabawi? November 11, at Look at several companies make a shortlist and review their performance for the past 2 years, and then chose at least four and not just one or 2 comanies to buy stocks, or diversify.

November 7, at 3: I have shares major on CHP, would you recommend to hold this for a long term? As well as EDC too. November 8, at 4: I would only recommend them for flipping, not long term. The stocks I recommend for long term are listed under Big 5 from Magic 10 stocks and from the Best Blue Chip page here. November 23, at I have Tel stock. The company is planning to change its CEO. Will it affect the TEL stock negatively? Changing CEO can either have positive or negative effect.

Technology is a fast-paced science so bigger challenges must be met as technology evolve. November 8, at 5: November 4, at 5: Yes, buy only when there is sign of reversal na uptrend para maximize ung average price ng stocks mo. November 3, at 4: November 3, at 5: November 4, at 9: November 7, at 8: November 10, at 5: October 27, at 8: Tuloy ko lang po ba yung monthly ko sa JFC, ALI at SMPH?

October 24, at 2: Just searching info in the internet and came across your DailyPik. I believed nagkaroon ng tendering offer but hindi ako nag avail. Thanks ang have a good day. October 23, at 3: I am new to stock market investing. Sa ngayon may hawak akong stocks ng MPI, tapos nabasa ko po itong post nyo about undervalued stocks. Pinakamalaki estimated growth ang FPH? November 2, at 2: I personally have FPH stocks din po. Sa dailypik ko po kasi nalaman na mgcforex din na may hawak na stocks na may malaking estimated growth lalo na for beginners kagaya ko po.

Yung sa holding period po very indefinite. Hindi po talaga malalaman gaano katagal.

ydigatocop.web.fc2.com | Feeding Your Dirty Doubting Minds. | » I Forgot My Pag Ibig Number and RTN Number! What Should I Do?

Hai nko yong portfolio ko natatawa nlng ako sumasabay sa undas hahaha but vb net bitwise operations enum ika nga. Relax lng tayo mga dudes kung may undas may pasko din???????????? October 13, at 8: Some of undervalued stocks po ang aking binili. Beginners pa po kasi ako. October 18, at RELAX LANG NORMAL LANG YAN HINTAYIN MU LANG NA MAKABAWI PAGMAY KITA NA PWEDE MUNANG IBENTA.

YUNG MGA MGA NAKALAGAY DYAN NA TARGET PRICE MOTNHS ANG AABUTIN OR TAON. October 21, at 3: Easy lang be patient, there is still an opportunity even when prices are down, just have enough cash reserve and buy when prices are down.

October 13, at October 11, at 3: Would you recommend investing on TEL? October 4, at Good day po miss Fehl, would you recommend buying CEB stocks now? Amidst the oil price rising at pag reduce ng production ng middle east? Nasa na price eh. September 29, at 1: October 4, at 1: October 4, at 4: September 29, at September 27, at Good day po miss Fehl, Ask ko lang bat po malaki growth percentage ng FPH?

September 28, at 1: FPH is fair to buy right now. September 9, at 5: Yung CHP po ba maganda siya sa panahon ngayon? Should I buy more since infrastructure ang pinakaconcern ng current administration or should I cut the loss? September 8, at 1: September 9, at 2: I wonder why you bought BLOOM? If you can still endure your loss, wait for the time to break even or gain a little but do not expect it will be so soon as FED hike decision is coming and also the holiday season.

September 13, at 1: Thank you for the advice! I had bought a few shares a long time ago when I was still very ignorant to stocks and its price crashed terribly. September 28, at 4: There is the possibility that will reach at 6. January 18, at April 17, at 2: September 5, at 3: Go for money market funds or bond funds if you want short term investment.

October 10, at 3: September 2, at 9: September 2, at 5: September 2, at 1: August 31, at Hi, umm I would like to ask if DMC holdings, like of the current situation of their price getting lower, is wise to stay? Or do you recommend I should just sell it? I lost around 3k in 2 weeks and I dont know what to do next. August 31, at 9: Newbie investor here and was so grateful sa inyong blog for latest info regarding investing sa stock market. Want to know ur view on Liberty Telecom tender offer?

August 31, at 8: September 1, at November 28, at 8: August 30, at 2: Your blog is a really big help lalo n sa mga newbie like me. Karamihan ng binili ko is from this site and I am now gaining. I just wonder why wala ang VITA sa list nyo? It continues to grow up.

Also, may pag asa po bang tumaas ang MRC and SFI? Elaine San Luis says. August 30, at August 26, at 3: August 25, at 2: Miss Fehl, do you handle stock-trading for other people?

And what stocks are best for newbies? Are real estate companies ok to be invest? August 26, at 9: August 24, at 5: August 18, at August 18, at 4: Ano pong meron sa ICT bat bigla po tumaas? Do you think I should hold or sell napo? May posibility po ba bumaba agad ulit? August 11, at August 9, at August 4, at It has a big drop.

August 8, at 9: August 8, at 4: Ongpin is being charged of illegal trading by the SEC it is been recommended that the latter will be unseat as of Board of Directors of listed companies.

Not Found

This is one of the reasons if not the main reason of the big drop of the stock. Please be noted that this my personal opinion only. August 4, at 9: John Benedict Paulite says. August 4, at 5: Boss, may question lang po. Pano kung na aim n ng company ung target price nya, or malapit n sya s target price nya??

Isold ko n ba sya?? August 26, at 4: August 26, at August 2, at 1: Finally, i have found a good trend blaster trading system free download for stock investing back home. Can i trade out of the country?

This is the best option for me while preparing to retire someday. Philippine stocks are on a roll right now. A lot of Filipinos have how to share money in farming simulator 2016 multiplayer money, but they dont know what to do with it.

We should have financial literacy subject in our curriculum. Keep helping our fellow Filipinos. Thanks Fhel and God bless. October 23, at Wow…i like your idea of including in the curriculum a subject on financial literacy. August 1, at earn money online without investment clicking ads What happened to SM? I check my COL account daily.

I did not see it drop so low on the percentage side. But for some reason, the price per share just dropped! August 1, at 8: I just read the comments on the Magic I knew this a while back but forgot about it.

August 3, at Payout is Sep 18 expect the number of your stock to double by then. July 29, at 7: Anyone can leave a comment ill appreciate it. July 31, at 1: October 3, at 6: July 29, at 4: Well dahil late na ko nag start puro negative po ung change po sakin. Normal lang po yan kapag bago pa lang. Meron po guide https: August 3, at 1: August 1, at Just wait the stock u buy is belong to the undervalued it takes more than a month before u see a green in your portfolio.

I experienced that lately I am also a new investor. July 28, at July 27, at 4: July 24, at 5: July 25, at 6: Maam guide to binary options market pulse ask ko lng po kung dapat ko nb ibenta ung stocks ko s MEG n 30percent n po ung kita o hintayin ko p mreach ung bgong target price n 6.

Kc naisip ko n ibenta nlng at 2016 players championship money earnings ulit s MEG once mreach ung BBP N 5. Ano po kya ung dapat kong gwin.

Thank you po s reply. July 26, at July 30, at 7: Check niyo na lang po sa pse dividends. July 22, at July 21, at 5: July 18, at 3: But we update canada stock option tax rate still everyday.

July 18, at 9: Hi make money blogging south africa for your reply. I have another question, if i want to buy BDO since it belongs to BIG 5 but base on blue chips, i should buy it when bbp is July 19, at 2: July 19, at 5: July 20, at 3: Just buy every month and invest for 5 years or so.

For Big 5 stocks, we use Target Period or Target Term not Target Price because our Big 5 stocks are recommended for long term investing.

Please read the article about Magic 10 to learn more. July 20, at 4: July 18, at I want to ask for your comment about BLOOM if it is worth investing or not? We already sold BLOOM when it reached its TP. Currently, it is not undervalued so it is not listed and recommended from our picks here. July 15, at 2: July 17, at 7: I agree that FPH is a bit sluggish. FPH has been moving sideways. FPH is moving sideways. But if u r into long term investment like me it is a good thing because it means u r buying in a low price.

July 15, at Should I sell it? Is there a chance that it price will drop or a stock might be on sleeping mode? July 15, at 3: July 17, at 8: If may doubt ka po on when to sell. July 13, at Is this a wrong move? July 14, fx rates nz 9: Ano po ung average price nyo ng MEG?

Kung ibig sabihin ng stock market term kayo, pwede nyo po hintayin kung kailan sya bumaba ulit and add more shares to average down. July 14, at 4: You have to stop buying kasi it is above BUY BELOW PRICE na and malapit ng ma HIT yung target price.

If you continue buying, mabibili mo lang yung share ng overpriced. Sayang din, pwede mo pang ipambili ng shares na nasa below buy below price na may mas malaking expected growth. July 9, at July 7, at 8: Thank you for this very informative site. I noticed that FPH and IMI have the biggest estimated growth. Does it mean these are also the most attractive stocks to buy now? Thank trading on options expiration day for your response.

Suggestion po nila na kung flipping po ang gagawin nyo, mas magnda pong maginvest sa may pinakamalaking estimated growth. Ang consequence lang po nito ay hindi po natin alam kung kailan po sila tataas.

Same to you, meron din akong FPH and planning to have IMI. July 7, at Fel anong masasabi mo sa HVN? Please maam, I need the informatio. July 1, at July 7, at 9: The first thing I look inside an IPO is about expansion of business. Paying debts is not a convincing signal for me. TIME is the essence. CEMEX has a huge loan from BDO 6. July 14, at Just want to say lang po na not ALL debts incurred for sp binary options trading signals review expansion would be considered GOOD DEBT.

Besides, personally lang din naman po. June 29, at 7: June 30, at 8: Fixed income stock po siya. Research na lang din po kayo more about it. July 26, at 5: Nice suggestion Joey, but preferred shares price are higher than the common right? I checked DD, its almost doubled on its preferred, lahat ba ng preferred ganon? And normally ilang percent higher ang div ng preferred compared sa common? June 29, at 2: June 27, at June 27, at 5: All stock markets are affected by the Brexit, not only the PSE.

UK is a big market and things will be uncertain with its economy, that will give impact to other countries including ours. June 23, at 9: Good day and thank you. More power, more inspirational blog and tips! June 22, at 4: WIll GlO and TEL be undervalued in the near future? June 21, at June 21, at 1: CPG has been idle for long time so we decided to remove it from our list here.

Moreover, our sources had not given enough data and updates for CPG. We have to let it go and break up with CPG for now. June 22, at 2: June 23, at June 20, at 3: Pero dito po sa undervalued stock, ang action po is to stop buying. The strategy for B5 stocks is different with the strategy of the above stocks here.

Please read the strategy about the specific stock wells fargo stock option services list.

They are usually discussed in the article. June 20, at 2: July 12, at June 20, at 7: June 24, at 8: June 15, at 1: But I am looking to get stocks that is good for flipping. Where do you usually check the prices of the stocks you have?

Also, once you place the stock for sale, is the price fixed once you place it on sale or the prices change until someone buys it? June 16, at 1: Hi, I have financial sources from the values we share here.

Please see our Reference page to learn more. I update the values daily and I get most of financial info weekly. June 13, at 4: I bought VLL when it was still high. My average cost now is 6. I was planning to cut loss and sell VLL when loss is not that big anymore. What would you do if you were me? Our Fair Value for VLL is 6. June 14, at 2: So the best option now is to continue buying to lower my average cost and sell when its time for reaping?

Thank you for the replies Ms. June 14, at Hi, What happened to DD stocks? Why the big plunge when there are people buying stocks at higher prices? Yung mga unang buyers po ng stocks at a lower price satisfied na sa gain ng stock nila kaya binenta na po, leading to a stock plunge.

June 13, at 2: June 6, at 8: But upon checking sa bloomberg they are in a downward trend starting January with a price as high as 11 per stock compared to right now which is fx option accounting entries 2. Will we be seeing an increase in the following months? June 10, at 7: June 6, at 2: I ibig sabihin ng stock market the power sector FPH, EDC, FGEN and ABS good fundamental, down because of lack of buyer.

Slow growth for property sector this year. If you want to go safe, buy in the banking sector. June 9, at 9: June 13, at June 18, at 1: Well base on the latest RSi if we use 14 period the RSI is 35 33 34 in june 15, 16 and 17 based on my computation.

June 6, at 1: Is SSI FV Value updated? Last quarter report, SSI net income decreased and some stores might close. June 6, at 9: Ask ko lng po if ok mag invest sa IMP ngaun?

My alam po ba kaung fb group. June 7, at 8: June 7, at June 8, at 6: July 4, at June 5, at 9: June 10, at June 1, at 8: May 28, at 6: May 27, at 8: Ano pong masasabi nyo sa SSI stock? May pagasa po bang umangat ito? Bumili po kasi ako nito ng 3 pesos last week, tapos ngayon 2. May 27, at May 31, at Net Income is not good last quarter and no sign of reversal. Too many competition in Consumer Sector. This might grow next year when they start adding stores. This might go down to 2. Buy NOW, BRN or HOUSE instead.

May 25, at 8: Do you have any plans on including MCP melco crown ph on your list? I wish to buy some shares but unless confirmed by a trusted and experienced investor of its potential I am unsure as I have no basis of its growth, its target price and all.

Hoping you can help. Add this is in your watchlist. May 22, at 5: May 24, at 6: May 18, at May 19, at May 17, at 5: Do you think this is positive news for VLL stocks?

Also in a recent Rappler article, Manny Villar said federalism is expected to benefit property firms should presumptive president Digong make it happen during his term.

April 29, at 7: Shall I continue to Purchase more from this? My target for this is for Long Term years. April 27, at 5: Kudos to you Ms. I have learned a lot from reading your guide about stock market, especially for a beginner like me. It is really worth the time reading your article. Hoping to read more articles about stock market. Again, thank you and God bless. April 27, at 9: April 22, at 8: April 26, at 8: I agree with Miguel.

April 26, at 5: I repeat, we have a Target Price here not Target Date. We are into long term investing although some of the stocks we flip can achieve their target in few months depending on the market.

We can never predict the market. April 20, at 2: FPH Target Price is in ColFinancial I bought FPH when it hits on its lowest price in january Now FPH is 70 per share.

If i keep buying FPH until it reach its BuyBelowPrice which is with my monthly budget 20k a month i will making a lot of profit. What do u think? May 8, at 8: I guess it is best to diversify your money. Try to buy stocks na very cheap like cpg, in your 20k makkbili kna ng madme and who knows bka yang current price na. I bought k shares last week with the current price of. May 17, at 6: April 16, at 8: Thank you for your blog. Though I just discovered this site just today.

I have 20 shares in SEVN and shares in 2GO. These stocks are not currently performing well, but is it possible that it will still get higher? April 5, at Do you think we still buy shares from them? April 8, at 1: April 12, at April 14, at 9: Fehl, since Col is already offering mutual funds.

Is there any chance you can also provide which funds to buy? April 4, at 2: April 2, at 3: April 19, at Hindi po napepredict ang stock market: I actually have some stocks for ilang months na din. March 30, at 4: March 30, at I am an avid fan of your site. Thank God for someone like you who is willing to share all your knowledge to others. Ask ko lang po — when I was new, bumili po ako ng BLOOM, ave price — Now it is trading way below at 5.

Sa tingin nyo po ba dapat ko ng ibenta to stop loss? I have shares ng nasabing stocks. April 29, at 6: BLOOM and RWM are also the source of my headache……. March 23, at 3: How did you come up with your computation of Buy Below Price? This would help us all newbie here on buying the correct price.

March 23, at I already asked the same question, I think a month ago. Did I understand it right. The question next is the TP? Is their a certain formula in getting the TP? March 26, at Base po sa aking observation, tinatakda po ata nila yung TP according sa mga past peak price na naabot ng isang company. March 22, at March 20, at 7: Good day mam, A newbie here.

I am looking into long time investment in stocks, just confused noob here, is stock flipping considered a strategy only but still long lime investment? I am with COL financial,i am afraid that when doing flipping, of stocks my gains will just go the the fees and charges of my broker…. The fees and charges of your broker is minimal. You dont need to worry about it as long as you are not an intraday trader. Flipping is not for long term. You can combine stock averagng and flipping if you think it is safer.

March 18, at 3: Well, how about that? For the first time since I started doing stock market in August of last year, CEB finally turns green on my portfolio! Fehl, you are a genius. So, thank you again. I probably will wake up Monday and see CEB on the red again. March 17, at 9: March 16, at 1: March 16, at 9: I started with Sunlife Mutual Funds as it has lower risks.

Reading this site has encouraged me to finally take the risk investing in stocks. June 16, at May i know how did you start your investment in Sunlife Mutual Fund? I am interested in investing but i dont know how. Hi, we have Mutual Fund guides here: I went thru an agent for the initial investment and enroll at sunlife online. For the succeeding investments, I transfer fund to their account thru metrobank and upload proof of bank transfer e.

They have detailed instruction on their website on how to add investment thru bank transfer. March 15, at 1: March 14, at 6: March 14, at 3: March 14, at 5: Last week we had new valuations for TEL and this week we removed it here as it is no longer undervalued.

March 18, at 8: March 13, at 5: Miss fehl, is it advisable to just invest in these big-time holding firms and not on its subsidiaries? March 14, at 4: March 14, at 7: March 10, at 8: Hello, expected pa po bang tataas ang ALI? Kasi po buy pa rin po ang recommended action kahit na lagpas na syang buy below price. March 9, at 8: March 8, at 8: March 9, at 3: Be patient and wait to gain some. You can also check out our Dividends page to know when TEL would give out dividends.

March 8, at 1: Hi, verify ko lang po, yung BBP ng CEB is po talaga?? Nung nagcheck kasi ako parang 98 lang po yung pinakamataas nya? March 8, at 5: March 8, at It is flying high na and almost naabutan na niya ang ALI. I think patuloy pa pagtaas nito eh but I dont know what will be the good entry. March 6, at 7: Sa katulad ko poh na long term investor. Is it ok toh invest 20yrs — 30yrs? I mean ill invest sa stocks na ganun ka tagal. Khit anong pag ka blue chips ng isang company. Once underlying fundamentals change like earnings.

Future of that company is uncertain! Kaya mejo nagugulohan ako at mejo nagdadalawang isip na mag invest sa stocks ng long term na goal is yrs. Salamat mo pa inyong future comments and reply. March 7, at 4: I think depende yan sa tao. Before ka naman mag-iinvest may goal and reasons ka na talaga. I flip stocks and I invest for long term. I sold TEL for last Feb 18, Then nagulat ako nagbagsak bigla. Not checking why, bumili agad ako ulit for Then late na ako nagcheck ng dailypik haha.

I heard nagdown sila kasi nalugi and matagal pa magcome back, mga 3 years pa? March 4, at March 4, at 3: March 3, at March 2, at 8: Good day, First time kong bumili ng stocks using BPI trade. Boom na place yung order ko at naibili yung stocks.

March 3, at 5: March 2, at I think the BBP and Target Price for TEL are interchanged. My portfolio is on the green again. First time since December. I forgot to change the BBP yesterday due to rush adjustment. Thanks for telling me about the error. May I know why? TEL is also into borrowing billions of funds to refinance debts and support its digital transformation strategy.

TEL is still a great company to invest with, the timing is just not attractive right now.

February 28, at Hi, I bought JFC for early this year. March 1, at 7: For me ok na rin ang SMPH at P20ish pababa. Yes, it might be under Property stocks, but it can be considered as well as Consumer Stock given that consumers tend to shop at SM more if they earn more.

February 22, at Ask lng poh ako. Sa bpi trade meron din poh ba sila set ka ng price ng e buy or sell mo kahit close ang market? Wala kasing oras mag abang if ooen ang market coz of work. February 21, at 4: If smph poh ba sa current price niya ngayon na 21ish mejo mahal pa or ok siya bilhin sa 21ish per share?

Salamat poh sa sagot. February 20, at 7: February 17, at 5: Salamat ng marami sa mga info regarding stocks. Question naman po regarding FPH and VLL. Kasama po yang dalawa na yan sa undervalued stocks ngayon pero ano po sa tingin nyo mas konti ang risk especially ngayon na hindi ganun kastable ang market natin. February 15, at 5: February 17, at February 17, at 1: February 18, at Sorry gai, i thought there is a stop loss feature in col but i cannot find it, its 1.

February 20, at 3: Magandang guide yung list sa taas…. Personally, para saken ok nman ang mga property sector sa stock market. But if maglalabas ka ng 20K for property might as well go with SMPH.

Hi, what i know with CPG is they have lot of finishing projects within and So i suggests you buy now. You are buying a discounted price. I am also observing the volume and price this week and it seems the buyers have lot of enthusiasm.

February 13, at Advisable poh ba bumili ng stocks ng JFC, SM at GLO for long term investment for 25yrs kahit na hindi siya sa buy below price? Salamat poh sa response. February 14, at Kung ako sa iyo antayin ko muna bumaba ulit si JFC sa pesos.

Para di ka maipit sa level. February 19, at 9: February 19, at Haha kung gusto mo magpa ipit kay JFC bili ka sa current price niya petot. Antayin mo lang bumaba, huwag magmadali, volatile pa ang merkado. February 14, at 4: There will be competitions in the future with Testra so it can be a risky for long term investment.

I think you need to use the BBP for you to get a discount and better annual growth rate. My advise is continue buying JFC, SM with BBP. But rather, yung pera mo mas ok lang ilagay sa iba. February 7, at 7: Fehl, based on your study and valuations mga ilang months bago ma hit yung TP ng mga undervalued stocks.

January 29, at Hi Fehl just drop a short message to say Thanks for sharing your GOD given talent on this field for a newbie like me. February 3, at January 27, at 7: Fehl, First of all, thank you po sa mga reviews at insights na shinashare po ninyo. Great help for us newbies in investing. Nice guide also in what shares to buy. I just read this particular company today and i wonder what is your stand or recommendation for the company Double Dragon properties DD?

Hope you can share your stand for the DD. January 28, at 2: January 21, at 3: January 16, at 4: Fehl, you are very great! As newbie, I have a lot of questions in my mind how the stock market is going on. One of this is, where did they got the open price were the last price sometimes is not the same in the closing price in the previous day.

Anyway, my important question to you Ms. Thank you po, just start learning in stock market. January 15, at January 12, at Hulog ka talaga ng langit sa mga katulad naming nagsisimula pa lamang sa stock investing. Pagpalain ka pa nawa ng DIyos.

January 12, at 2: January 9, at We only recommend them for flipping. You can go to the list of Blue Chips instead. January 20, at December 28, at December 25, at I bookmarked this page. When I have time I will test this table with real account, it seems very interesting.

Do you have some tests with real account that you can share? December 29, at I have no words to express how much i am thankful for your FREE Stock picks. Hindi ko kasi afford ung subscription sa iba. Pang load na un isang buwan eh. Dyos na bahala sayo. Maximino Javar Jr says.

November 30, at Fehl, thanks for searching you sa blog na ito. Thank you so much. November 26, at 5: Hi Ms Fhel Im quite new to your site and i find it very helpful, thanks.

Just wondering, how come BDO is not included in your stock pick? Whats the news of BDO? This article is about undervalued stocks. BDO is currently not undervalued that is why it is not included in this list. See separate article for magic 10 stocks where BDO is included.

December 14, at 1: Hi just wanted to ask, everytime the stock price go down, for example I bought it at 5. Doesnt that mean the price keeps fluctuating rather than increasing to reach the TP? December 15, at Depends on the type of stock. November 25, at 3: November 25, at 7: SO…I checked PSPC just now. So, better hold onto it and sell when that time comes if you think PSPC is not worth holding for the long term. It might be better if you asked around before buying, rather than after losing.

December 3, at 7: November 17, at 1: I can still tolerate the loss… but not seen any light at the end of the tunnel… your honest opinion is really much appreciated.

November 13, at 5: Thanks Ms Fehl for this incredible reference… Just want to ask for the formula for getting the Buy Below Price…TIA. Hi Miss Fehl, first I want say thank you for sharing your knowledge in stock. I have just started to invest in stock a few months ago and bought a few stocks.

I just want ask you what percentage of loss that can be considered tolerable? So far all of the stocks in my portfolio shows a red mark. Thanks a lot, hope you can respond. November 11, at 1: November 10, at I appreciate your reply.

November 11, at 2: November 11, at 8: November 28, at 6: November 10, at 9: Fehl, how often do you update this page?

Is it already a good entry point? We update them everyday 3x usually. Clearing your browser cache would help. TEL is dropping and I think it will likely continue that slope but eventually recover. November 10, at 1: November 10, at 3: I have SSI and I bought it 7. December 2, at 4: November 7, at 5: Hi ms fehl, 1st time to come across your blog and im glad i did. November 9, at 7: November 12, at 5: Thank you sa advice.

Thanks for the reply ms fehl. November 6, at 4: Fehl, Is it good to invest for flipping in EEI especially now when it plummeted to a new week low of PhP 6. November 6, at 8: November 7, at You sold at a loss?

November 8, at 1: Based sa COL report EEI: Two Saudi Arabia projects incur losses; to adversely affect 3Q15 earnings. A day before lumabas yung news nag cut loss na ako. November 6, at 9: November 5, at 8: November 5, at 1: November 4, at