Buy dow jones industrial stock market crash

Stock is an instrument that signifies an ownership position called equity in a corporation, and represents a claim on its proportional share in the corporation's assets and profits. Ownership in the company is determined by the number of shares a person owns divided by the total number of shares outstanding. Most stock also provides voting rights, which give shareholders a proportional vote in certain corporate decisions. Only a certain type of company called a corporation has stock; other types of companies such as sole proprietorships and limited partnerships do not issue stock.

Stock Market Essentially a market is a place which introduces a buyer to a seller. In the case of stocks the buyer and seller are dealing in small ownership portions of companies or shares.

Stock markets perform the following functions:. Stock market indices may be classed in many ways. A broad-base index represents the performance of a whole stock market— and by proxy, reflects investor sentiment on the state of the economy. The most regularly quoted market indices are broad-base indices including the largest listed companies on a nation's largest stock exchange, such as:. The concept may be extended well beyond an exchange.

The Dow Jones Wilshire Total Stock Market Index , as its name implies, represents the stocks of nearly every publicly traded company in the United States , including all stocks traded on the New York Stock Exchange and most traded on the NASDAQ and American Stock Exchange.

The Europe, Australia, and Far East Index EAFE , published by Morgan Stanley Capital International, is a listing of large companies in developed economies in the Eastern Hemisphere. What helped Wall Street rise to pre-eminence was the emergence of two great Stock Exchanges, which gave order to the chaotic trading and gave birth to the financial markets as we know them today.

The year was The place was Philadelphia.

The occasion was the founding of the first stock exchange in America. Two years later a group of New York merchants met to discuss how to take command of the securities business. The merchants, a group of 24 men, founded what is now known as the New York Stock Exchange.

But in early , the merchant group from New York, distressed at the sorry state of their stock exchange, sent a representative to Philadelphia to observe how things were being done. Upon arriving with news about the robust exchange in Philadelphia, the New York Stock and Exchange Board was soon formally organized.

DJIA - Dow Jones Industrial Average - CNNMoney

The exchange opened up shop on Wall Street. As for the New York Stock Exchange, it has since moved past its humble beginnings to the point where its system now facilitates billions of dollars worth of trades each day.

But there was a gradual build up to this sort of status. In the early s massive amounts of money were made on Wall Street. But the boom period could not be sustained indefinitely. And in this principle came front and center as the stock market crash of seared the national, nay, global, psyche and triggered what was to be called the Great Depression.

Gold prices rise as fears of Dow Jones stock market crash take hold ahead of Trump-Xi meet | City & Business | Finance | ydigatocop.web.fc2.com

While many of the powers that be realized that the markets could not sustain a boom forever, very few publicized this view, choosing instead to let the market be its own judge, jury and executioner. As a result of the laissez-faire attitude, many people, rich and poor alike, lost a lot of money. But the stock market crash of was just the beginning of sorrows for Wall Street. For while the economy eventually recovered from its catastrophic losses, the market excesses that had factored into the crash in the late s seeped back into the picture.

The result was the stock market crash of , which saw the Dow Jones suffer what was the largest single-day loss in the stock market's history. Since then, the government and the industry have tried to put measures in place to curtail, if not entirely eliminate, the possibility of such a large-scale crash.

The stock markets are now an integral part of the global economy, and so proper safeguards to reduce the risks of another disastrous crash are necessary. But while efforts have been made to reduce the risk, the possibility for another stock market crash can never be ruled out.

From the BBC "Market Crashes Through the Ages". These computers are networked together using sophisticated protocols. This level of information sharing makes pricing an almost exact science. These , computers are further linked to another 26 million computers worldwide.

These computers are located in banks, small businesses, and large corporations. These computers comprise the banking networks which make computerized transactions possible. As a collective, these market indexes are referred to as the Security Market Indicator Series SMIS. They provide a basic signal of how specific markets perform during the day. Of these three, the DJIA is the most widely publicized and discussed.

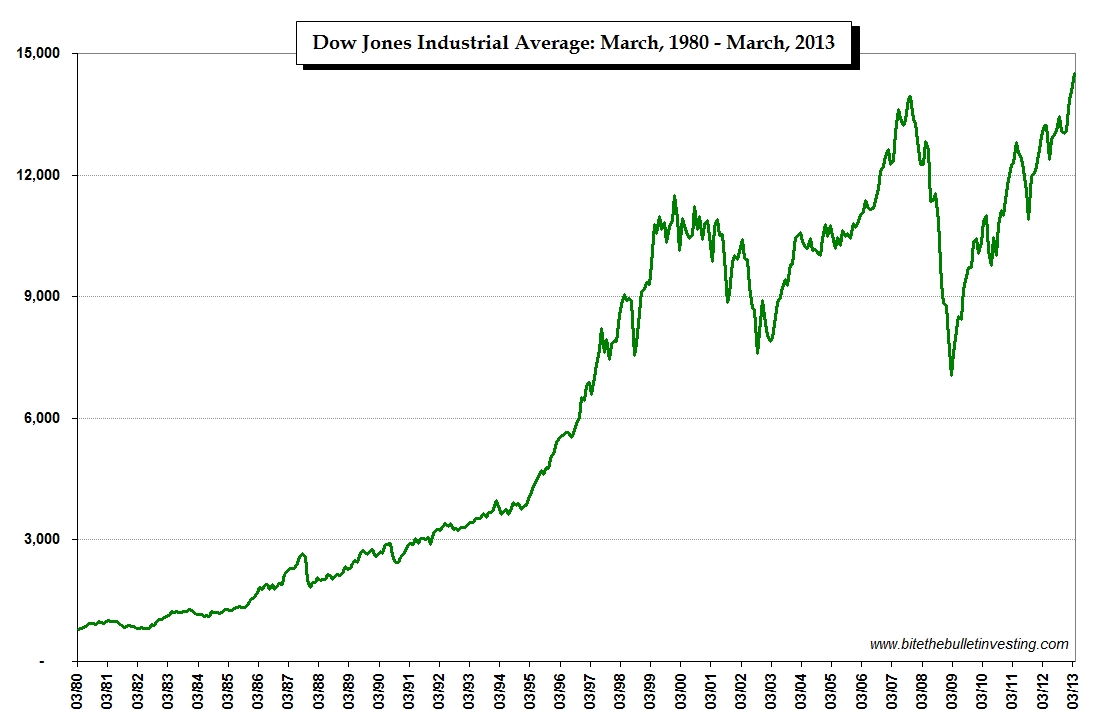

Charles Henry Dow — American economist and publisher who with Edward D. In he founded the Wall Street Journal. Dow also called Dow Jones Industrial Average DJIA is a benchmark that tracks American stocks that are considered to be the leaders of the economy and are on the Nasdaq and NYSE. The DJIA covers 30 large-cap companies, which are subjectively picked by the editors of the Wall Street Journal.

In fact, of the initial companies included, only General Electric remains as part of the modern-day average. The Dow is computed using a price-weighted indexing system, rather than the more common market cap-weighted indexing system. To calculate the DJIA, the current prices of the 30 stocks that make up the index are added and then divided by the Dow divisor, which is constantly modified. Thus, if the DJIA was up points on the day, GE was responsible for The US stock market boomed together with the economy and peaked in September The usual and familiar accusations were made and have since been repeated.

Speculators were 'evidently' responsible for driving stock prices away from their fundamental value, causing a bubble in the market.

Speculators were aided by 'easy credit' from banks and stock-market brokers. Not just the stock market crash was blamed on speculators, but, even more, speculators and the stock market were blamed for the entire Great Depression.

The fundamental value of stocks is the discounted present value of expected future dividends. Due to dividend smoothing and other considerations dividend payments usually lag earnings of firms. It is not surprising for example that during share prices of utility companies rose strongly, although most of these companies had not paid any dividends.

Utility companies were seen to benefit from the expanding sale of electrical appliances and used their earnings to increase investment rather than distribute as dividends. RCA also did not pay dividends.

How to Invest in a Stock Market Crash: Global Economy, Trading, Brokers, Finance (1987)Even without complications from dividend-pay-out policies, the data show that from the early s stock prices followed the increase in dividend payments. Estimates show that in stock prices implied expected dividend growth rates that were lower than the actual post-WW2 growth rates Sirkin, At the time, professional economists provided no consensus view, but a number of them also argued that the stock market was in line with fundamentals among them the famous Irving Fisher.

After the October crash share prices recovered slightly. But from early to mid the stock market and its fundamental value followed the downward trend in economic activity and dividends, its level adjusted for an in increase in the risk premium.

Stock Market Data - Dow Jones, Nasdaq, S&P - CNNMoney

Thus, apart from the direct cause of the panic selling on a few days in October , and perhaps the magnitude of those single-day price declines, there is nothing particularly strange in the behavior of stock prices before or after October The stock market peaked September 3, On September 5, Roger Babson addressed the National Business Conference and predicted that a sharp recession was in the offering. We now know that the index of industrial production actually peaked in June Restrictive monetary policy by the Federal Reserve was a major cause of the recession.

Many investors had bought stocks on margin, with borrowed money using stocks as collateral, and were liable for both interest rate costs, loan repayment and additional margin calls when prices decline. When prices declined and hope of a speedy recovery faded, the number of margin calls increased.

Many were forced or attempted to sell their shares, and through sheer size of volume brokerage firms were swamped and prompt reporting of prices became impossible. Information on transaction prices was unavailable. Furthermore, speculators had a perverse incentive to stay away from the market in order to benefit from the distress sale and free fall in prices.

Buying stock on margin was one of the factors leading to the crash. Buying on margin is borrowing money from a broker to purchase stock.

You can think of it as a loan from your brokerage. Margin trading allows you to buy more stock than you'd be able to normally. There is nothing particularly strange in the mechanics of the October stock market crash es. Calculations with respect to a 'rational' fundamental value for the stock market in show that the market was not definitely overvalued at the time, given ex ante expectations of a hypothetical rational investor. In the following years the stock market simply followed the decline in economic activity and the general price level.

Blame for the Great Depression cannot be found in the stock market, but rests with a failure of monetary policy. Erasmus School of Economics. In the Securities Exchange Commission SEC was created to protect investors in the wake of the stock market crash. The SEC continues to protect investors today, adding stability to investors' confidence and the markets in general.

The SEC takes approximately civil enforcement actions against individuals and companies that violate the law each year. The SEC regulates basically anything related to the securities markets.

This includes individuals, investment advisors, mutual funds, broker-dealers, and public companies. Common enforcement actions include: Without the SEC, investment fraud would be commonplace and the markets would be much more unstable.

The Federal Reserve System also the Federal Reserve ; informally The Fed is the central banking system of the United States. The Federal Reserve System is composed of a central Board of Governors in Washington, D. Alan Greenspan currently serves as the Chairman of the Board of Governors of the Federal Reserve. The first institution with responsibilities of a central bank in the U. Later, in , the Second Bank of the United States was chartered.

After a series of devastating bank runs , it was decided that the US needed a centralized banking system.