Bank of america cash-back deals system launches nationwide

Below are interesting stories the Banking. What have you been reading?

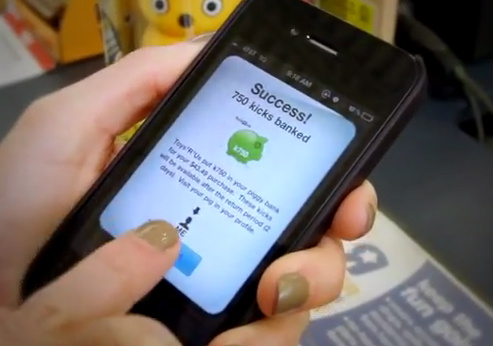

Let us know in the comments section below or Tweet bankingdotcom. Bank of America announced the nationwide launch of its online rewards system, BankAmeriDeals. The system allows consumers to select deals online or through a mobile app and then redeem those offers by spending with an eligible Bank of America credit or debit card.

The bank began testing BankAmeriDeals internally with Cardlytics in January, and has since rolled out the system regionally to consumers. Apps for accepting customer credit cards on mobile devices such as smartphones and tablets are becoming big business.

And major companies such as PayPal and accounting software provider Intuit have created their own payment apps, too. For small businesses, that means there are more options for simpler credit card processing or an inexpensive point-of-sale system. Whilst perhaps still not at the level the regulators want, shopping around for better financial deals is becoming much more prevalent in the UK, particularly in the insurance, credit card and mortgage markets.

As a result, there is a huge market in lead generation, with comparison websites spending huge sums on TV advertising, resulting in merchants and demented opera singers being amongst the most recognized people in the UK!

American Express - Wikipedia

This weekend saw a number of interesting developments that raises the question as to whether we are on the cusp of another step in the realization of financial services, and perhaps into a very different type of universal bank. In the consumer category, Wells took the top spot in best bill payment, best website design and best in social media.

In corporate, Wells was tops in website design, mobile banking and online treasury services. Key questions that our research addresses still remain: If a consumer could start ordering earlier in the long early morning queues or loyalty benefits such as discounts or coupons are integrated the mainstream consumer will be standoffish.

Business News, Personal Finance and Money News - ABC News

For more details, see our data on consumers who are early adopters of mobile payments, banking, alerts and more, along with analysis of the solutions offered by various providers. The mobile payments industry may have entered adolescence this week. In another sign of apparent maturity, most of the major players in mobile payments with one big exception, its poster-child, Square — more on that in a moment are forming an alliance to solve the problems that arise when trying to transition from novelty to norm.

Thought leadership for banking and financial services professionals. Read more The Pros and Cons of Mobile Payment Services Entrepreneur. Read more Putting the retail into retail banking Celent Banking Blog Whilst perhaps still not at the level the regulators want, shopping around for better financial deals is becoming much more prevalent in the UK, particularly in the insurance, credit card and mortgage markets. Read more Wells Fargo named best Internet bank in U.

Read more Alliance Wants to Make Mobile Payments the New Norm, But Where Is Square?

Wired The mobile payments industry may have entered adolescence this week. Related articles How can banks streamline the onboarding process? June 14th, Making omni-channel a reality — Part 4: Assess your operating model June 12th, How omni-channel marketing can work for your business — Part 3: Manage May 31st, Tweets Tweets by bankingdotcom. We use cookies to ensure that we give you the best experience on our website.

If you continue to use this site we will assume that you are happy with it.