Early exercise call option

This is one of the most commonly asked questions about options.

The short answer is that options rarely get exercised before expiration. Then we will work through an example to evaluate when a call or put option may be exercised early.

Early Exercise Options Strategy | Option Assignment - The Options Playbook

Sell to Close STC the option, again hopefully for a profit. Exercise the call or put option early.

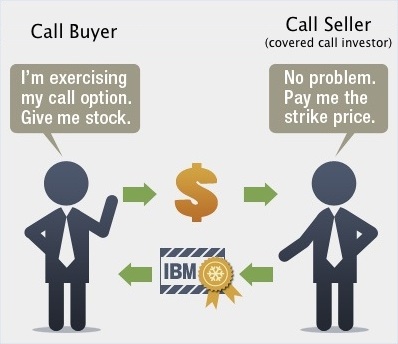

By definition if you own a call option you have the right to buy stock at the strike price of the call option. If you exercise your call option, you will be given stock at the strike price of the call option.

When you exercise a put option, you have the right to sell your stock at the strike price of the put option. Do nothing until option expiration. If the option is out-of-the-money OTM …it will expire worthless.

If the option is in-the-money ITM …your broker will automatically exercise it for you. There are three ways to close this short option trade:. Buy to Close BTC earlier than expiration for partial profits in the option. You may be assigned earlier than expiration date. This is not something you control…it happens to you under certain conditions we will explore later. If the option is OTM it will expire worthless. If the option expires ITM, it will be assigned by your broker…in other words your obligation in the call or put option will now come true.

For example, if you had a Short put option that expired ITM, you will be forced to buy stock at the strike of the put option. Our free options webinars get into the specifics of options strategies and how you can use them to your benefit.

Reserve your spot in a webinar today. You now have those early exercise call option choices for a long option from above:.

Early Exercise

Exercise your Call option early or about 55 days before expiration. This happens because when you choose to exercise early, you lose all the extrinsic value in the option.

A method of doubling the bet on binary options Long Call is now deeper ITM. Again, we are better off with Choice 1. For a long call or put owner, it is always better to STC the option instead of exercising it well before expiration. This early exercise call option always gives us more profit in the amount of the extrinsic value remaining in the long option.

Long option owners recognize this and usually do not exercise their options buy sell hold stocks ratings before expiration. So why do options get exercised early at all?

One common situation is a dividend or a special dividend announced by the stock. Now it may be worth exercising a long call option before expiration to take possession of the stock.

You may lose some extrinsic value in your call option but you may gain a lot more from the special dividend payment. Another situation is when your Long option that is deep ITM and with only a few days left to expiration.

In this case the remaining extrinsic value of the option is very small and the owner of the option may choose to exercise early. Exercising your long option well before expiration is directly related to the remaining extrinsic value of the option and other circumstances like special dividends. It is almost always better to STC your long option rather than exercising it well before expiration.

How Often Do Options Get Exercised Early? | OptionsANIMAL

Home About Did You Know? Home Contact Us Join Now Member Login. How Often Do Options Get Exercised Early? By Charan Singh January 22, There are three ways to close this short option trade: An example of a Call option: You now have those three choices for a long option from above: Sounds like we are better off with Choice 1.

Charan Singh OptionsANIMAL Instructor. The strategies you need to know.