Correlation coefficient market portfolio

Individual Investment The expected return for an individual investment is simply the sum of the probabilities of the possible expected returns for the investment. For Newco's stock, assume the following potential returns. Portfolio To determine the expected return on a portfolio, the weighted average expected return of the assets that comprise the portfolio is taken.

Assume an investment manager has created a portfolio with the Stock A and Stock B. What is the expected return of the portfolio? Computing Variance and Standard Deviation for an Individual To measure the risk of an investment, both the variance and standard deviation for that investment can be calculated. Variance and Standard Deviation of an Investment Given the following data for Newco's stock, calculate the stock's variance and standard deviation.

Given that the standard deviation of Newco's stock is simply the square root of the variance, the standard deviation is 0. Covariance The covariance is the measure of how two assets relate move together.

If the covariance of the two assets is positive, the assets move in the same direction. For example, if two assets have a covariance of 0. If however the two assets have a negative covariance, the assets move in opposite directions.

If the covariance of the two assets is zero, they have no relationship. Given the following returns over the past 5 periods, calculate the covariance for Asset A as it relates to Asset B. Correlation The correlation coefficient is the relative measure of the relationship between two assets.

Calculate the correlation of Asset A with Asset B. Given our covariance of 18 in the example above, what is the correlation coefficient for Asset A relative to Asset B if Asset A has a standard deviation of 4 and Asset B has a standard deviation of 8.

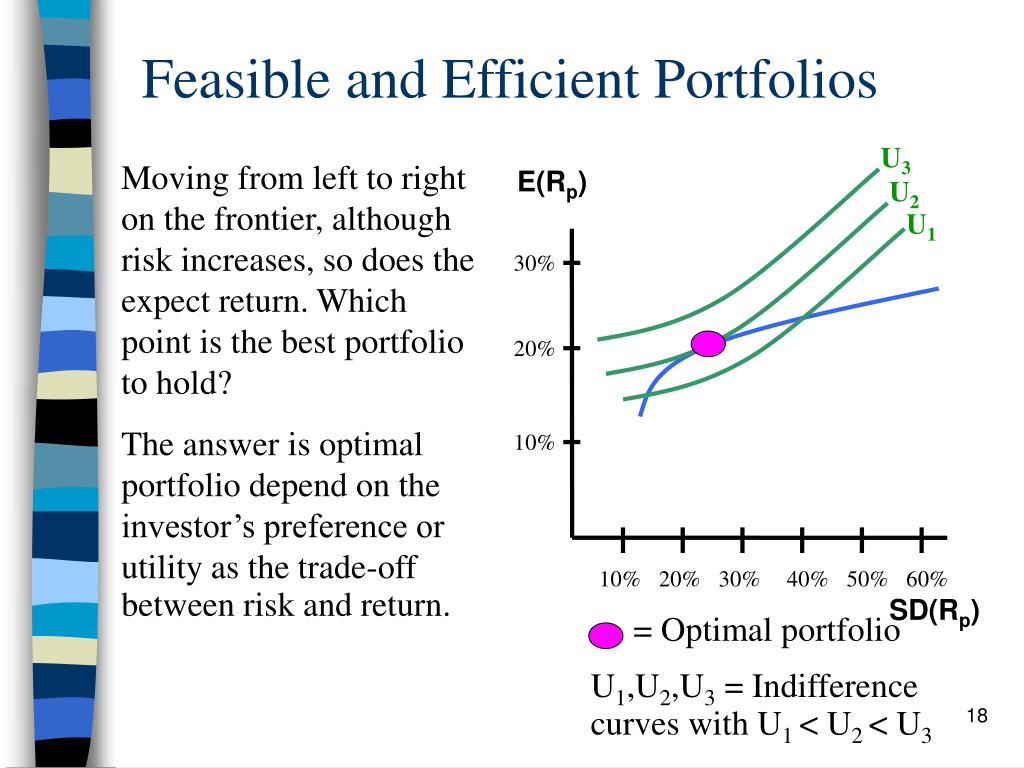

Components of the Portfolio Standard Deviation Formula Remember that when calculating the expected return of a portfolio, it is simply the sum of the weighted returns of each asset in the portfolio. Unfortunately, determining the standard deviation of a portfolio, it is not that simple. Not only are the weights of the assets in the portfolio and the standard deviation for each asset in the portfolio needed, the correlation of the assets in the portfolio is also required to determine the portfolio standard deviation.

The equation for the standard deviation for a two asset portfolio is long, but should be memorized for the exam. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Portfolio Calculations By Investopedia Share. Chapter 1 - 5 Chapter 6 - 10 Chapter 11 - 15 Chapter 16 - Ethics and Standards 2. Global Economic Analysis 1.

Knowledge of the Law 1. Independence And Objectivity 1. Material Nonpublic Information 1. Loyalty, Prudence And Care 1. Preservation Of Confidentiality 1. Duties to Employers, Standard IV-A: Additional Compensation Arrangements 1.

Responsibilities Of Supervisors 1. Diligence And Reasonable Basis 1. Communication With Clients And Prospective Clients 1. Disclosure Of Conflicts 1. Priority Of Transaction 1. Composites And Verification 1. Disclosure And Scope 1. Requirements And Recommendations 1. Fundamentals Of Compliance And Conclusion 2. Real GDP, and the GDP Deflator 4. Pegged Exchange Rate Systems 5. Fixed Income Investments The Tradeoff Theory of Leverage The Business Cycle The Industry Life Cycle Intramarket Sector Spreads Calls and Puts American Options and Moneyness Long and Short Call and Put Positions Covered Calls and Protective Puts.

Covariance is a concept used in statistics and probability theory to describe how two variables change when compared to one another. In business and investing, covariance is used to determine Think of standard deviation as a thermometer for risk, or better yet, anxiety.

Normal or bell curve distribution can be used in portfolio theory to help portfolio managers maximize return and minimize risk. Check out how the assumptions of theoretical risk models compare to actual market performance.

Learn how to follow the efficient frontier to increase your chances of successful investing. The synchronized movement among stocks and markets in recent years is challenging diversification. Excel is a useful tool to assist with investment organization and evaluation. Find out how to use it. Use these calculations to uncover the risk involved in your investments. The empirical rule provides a quick estimate of the spread of data in a normal statistical distribution.

Portfolio Risk and Return

You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Correlation

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.