Volga of a call option

In earlier chapters we have seen:. We used implied volatility surfaces to plot the behaviour of volatility across these two dimensions. As part of this exploration process we will introduce the concept of Shadow Gamma and Vanna — both instances of what we could call cross Greeks.

Since by now we have spent sufficient time with the concept of surface plots, we will also add a new dimension, the underlying asset price, to our surface plots. We can use either of the two equations to calculate Vega.

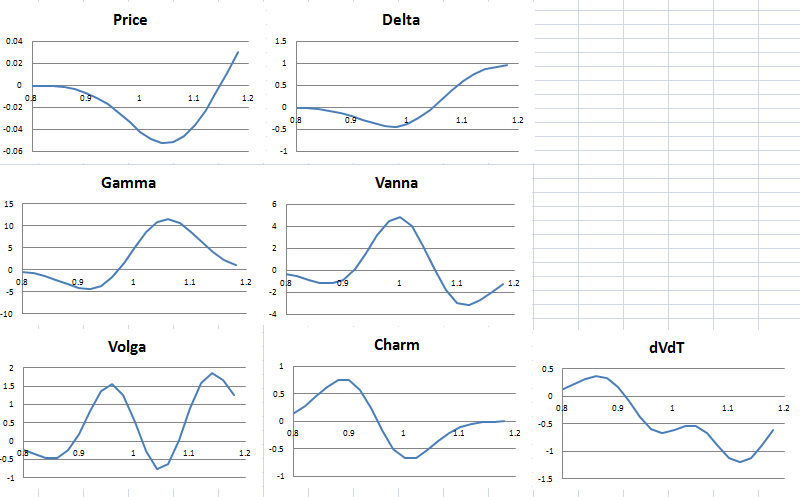

Similar to Gamma, the value of Vega is the same for both call and put options. Volga or Volatility Gamma determines the rate of change in Vega on account of a unit change in volatility. The same relationship convexity has with duration and gamma has with delta.

Vega, Volga & Vanna. The option volatility Greeks

Unlike Gamma where Gamma peaks with a reduction in time for at the money option, for Vega, Volga and Vanna, it is increasing time that give volatility an opportunity to impact option value. The Vega Greeks will decline as time to expiry comes closer to zero.

This creates different choices that need to be balanced when we try to hedge Gamma and Vega together.

Option Greeks Explained | The Options & Futures Guide

The plot below calculates value of Vega and Gamma for an option against changing level of strike prices. In this specific case the current spot price lies between and which is where at and near money where Vega peaks.

Despite the fact that fact that we have a different scale for measuring Vega and Gamma, the interesting thing in the above graph is the similarity in shape for the two Greeks. Figure 1 Vega and Gamma against spot. It is when we plot Vega against changing expiry for deep out of money options and at money options that we see a difference emerging in the relationship between Vega and Gamma. For deep out of money option reducing time to maturity reduces both Vega and Gamma. Figure 2 Vega and Gamma against spot — deep out of money options.

The Greeks – Quantopia

For at the money option, the impact of time on Vega and Gamma is the exact opposite. Vega rises as we increase time to expiry.

Gamma rises as we decrease time to expiry. Figure 3 Vega and Gamma against time — at the money options. Privacy Policy Site Map. ALM, Risk and Simulation Models — Training, Study Guides, Templates. Vega, Volga and Vanna. The option volatility Greeks. Jun 09, by Jawwad Farid in Greeks Vega, Volga and Vanna.

Vega is the change in the value of the option with respect to change in volatility. In earlier chapters we have seen: Calculating Vega The equation for calculating Vega is given by: Since assume no dividends, the formula simplifies to: Calculating Vanna In the Black Scholes model, Vanna is calculated using the following equation: Volga — Volatility Gamma Volga or Volatility Gamma determines the rate of change in Vega on account of a unit change in volatility.

It is also possible to express both Vanna and Volga in terms of Vega.

We know that Vega is given by: Plotting Vega and Gamma The plot below calculates value of Vega and Gamma for an option against changing level of strike prices. Figure 1 Vega and Gamma against spot Vega and Gamma against time. Figure 2 Vega and Gamma against spot — deep out of money options For at the money option, the impact of time on Vega and Gamma is the exact opposite.

Figure 3 Vega and Gamma against time — at the money options Related posts: Cross Greeks , Higher Order Greeks , Vanna , Vega , Volatility Greeks , Volga. Jawwad Farid has been building and implementing risk models and back office systems since August Working with clients on four continents he helps bankers, board members and regulators take a market relevant approach to risk management.

He is the author of Models at Work and Option Greeks Primer, both published by Palgrave Macmillan. Jawwad is a Fellow Society of Actuaries, FSA, Schaumburg, IL , he holds an MBA from Columbia Business School and is a computer science graduate from NUCES FAST.

He is an adjunct faculty member at the SP Jain Global School of Management in Dubai and Singapore where he teaches Risk Management, Derivative Pricing and Entrepreneurship.

Popular Posts 1 Capital Allocation Calculating Economic Capital — A Case Study. Commodities The knives are out in the Oil market. Computational Finance Implied and Local Volatility Surfaces in Excel — Final steps. Asset Liability Management Liquidity Risk Management — A framework for estimating liquidity risk capital for a bank.

Bitcoins A short visual history of Bitcoin bubbles. Case Study Jet Fuel Aviation Hedge Case Study — Hedge effectiveness calculation. Recent Posts Risk Stress testing correlation — The positive correlation stress test 0 Comments. Derivatives FX Currency Options — The USD JPY FX options convention 0 Comments. Case Study TARF hedge effectiveness model 0 Comments.

Case Study Hedge effectiveness of vanilla options, TARF and participating forwards. Treasury Products Mis-selling in FX Markets — Losses from zero cost investments 0 Comments. Tags Asset Liability Management basel 3 Basel II Basel III Basel Three Case Studies Corporate Finance CPE Credit Derivatives Editors Choice Exotics Finance ICAAP Internal Capital Adequacy Internal Capital Adequacy Assessment Process Option pricing Options Pricing risk management Travel Value at Risk.