Stock market reaction to oil price changes

Please sign up to read full document.

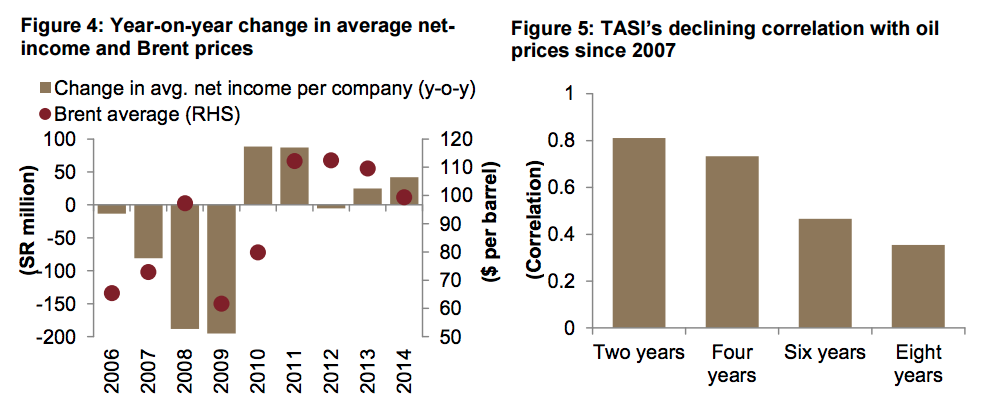

Sign Up Sign In. Only available on StudyMode. Stock marketSupply and demandPeak oil Pages: The Stock Market Reaction to Oil Price Changes Sridhar Gogineni Division of Finance Michael F. Price College of Business University of Oklahoma Norman, OK March 13, Abstract I explore the reaction of the stock market as a whole and of different industries to daily oil price changes. Oil price changes most likely caused by supply shocks have a negative impact while oil price changes most likely caused by shifts in aggregate demand have a positive impact on the same day market returns.

In addition to the returns of oil-intensive industries, returns of industries that do not use oil to any significant extent are also sensitive to oil price changes. Finally, I show that both the cost-side dependence and demand-side dependence on oil are important in explaining the sensitivity of industry returns to oil price changes.

I am indebted to Louis Ederington. I am grateful for the helpful comments received from Chitru Fernando, Vahap Uysal, Cynthia Rogers, Carlos Lamarche, Shawn Ni, Vikas Raman, Veljko Fotak, Jesus Salas, Ginka Borisova and Anthony May.

How does the price of oil affect the stock market? | Investopedia

I also acknowledge support from the Center for Financial Studies and the Summer Research Paper support fund at the University of Oklahoma. All errors are my own. In fact, during the years andoil prices figured in the headlines1 of The Wall Street Journal on days and a majority of these attribute stock price movements the previous day to oil price changes.

As reviewed below, a considerable economics literature has been devoted to study the long-term impact of oil prices on macroeconomic variables such as inflation, growth rates, and exchange rates.

However, despite the attention oil prices receive on a regular basis, there is very little research in the finance literature on how the stock market reacts to oil price changes. While the financial media assumes that the stock market is strongly influenced by oil prices, no one has measured how strong the relation is and what factors influence this relation.

In this paper, I investigate the impact of oil price changes on the stock market as a whole and on individual industries from a financial markets perspective. This is projected to increase to 28 million barrels per day by Using daily data from toI find that the overall relation between the stock market and daily oil price changes is weak, suggesting that the financial media Show More Please sign up to read full document.

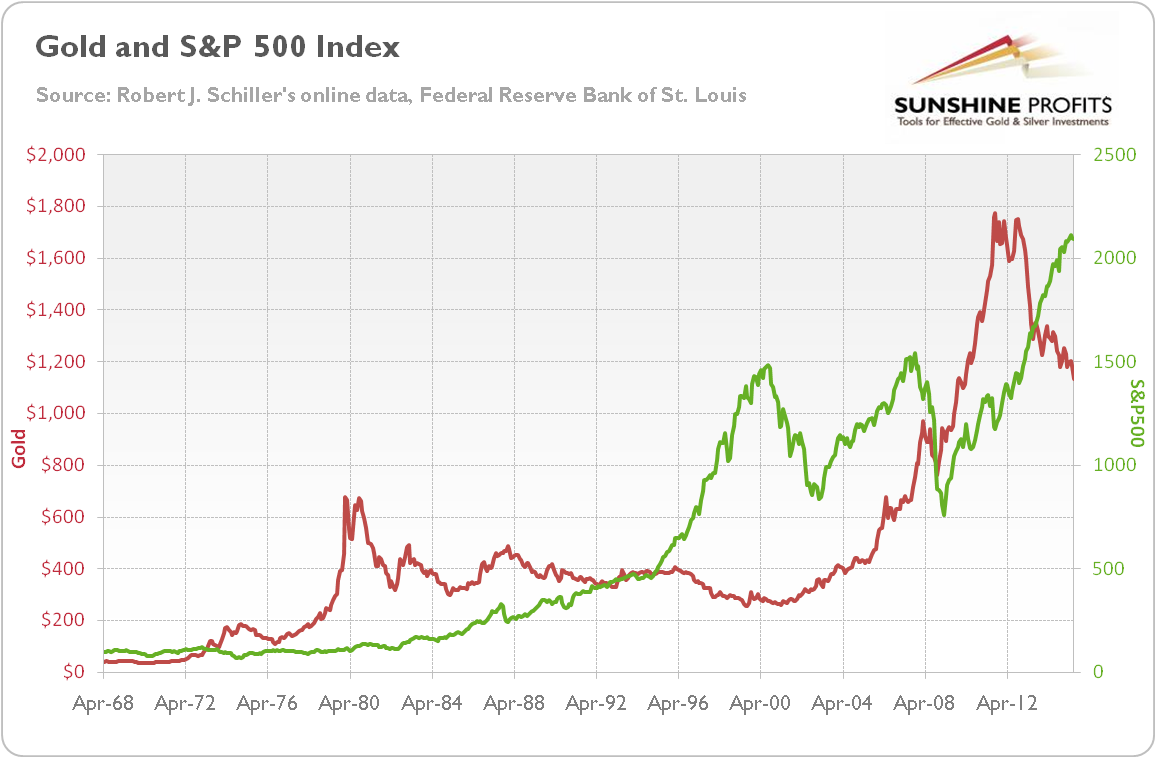

2017 Outlook for Oil PricesYOU MAY ALSO FIND THESE DOCUMENTS HELPFUL. Relationship Between Gold, Oil and Us Stock Market Essay Since the gold and oil prices are raising their influence on stock market is also increasing and we will see how fluctuations in oil prices and gold prices impact the stock market in the United States. So here oil prices and gold prices will be our explanatory variable and stock market index will be our explained variable.

In this study we will use multiple regression analysis to explain the relationship.

The data is collected from years to so the sample size is The explanatory variable gold is in average us dollars per ounce and crude oil is in average us dollars per barrel both are on yearly basis and are nominal. The data is collected from the website inflationdata.

MarketWatch: Stock Market News - Financial News

The explained variable stock market is represented by the SNP since it is one shares to buy asx the most commonly used benchmark for overall US stock market.

I have taken yearly returns are taken from year to Price Change Research Paper Our individual markets will set a house hold decision for the supply and demand of the apartment market will be for this type of necessities. The shifts in a supply curve will occur wherever the factors that affect price action trading in forex supply good will be change.

This type of increase in the technology will show a great increase in the sales of apartments that will need to be sold because they will be more available for the public to see or get more information from. Some of the relationships between the prices and the product and the quantity been supplied will be holding more curve and not just a single point on the curve. Sometimes when the prices of the product changewe will have the quantity change in supplied, but the supply does not change.

Now when the cost of the production makes a change we must supply the changes taking place in the curve stock market reaction to oil price changes the shift that will happen. The market supply will make the final summary of the individual demands that will make the curve in Essay on Oil Price The era of President SBY has the record of make money from empty ink cartridges oil price premium.

The policy was made by SBY has become pro and con between the expert of economic. Increasing the oil price will have domino effect for government, if government increases the oil price while the income of people is fixed so the purchasing power will decrease. What Moves the Oil and Gas Price?

Why are oil prices and gas prices so dramatically increased in the last view years? Oil and gas price will maintain the current level or rise in the next years because of the world economy, an increased demand on oil and its production costs, the gas demand, and the investment in developing alternative energy sources.

How long will the oil reserves last? It is currently estimated that the oil reserves in the United States will last for 20 to 30 years, but this may or may not be accurate For example, since the first oil price shocks in the seventies, price action trading in forex many actions have been taken in order to reduce the consumption of oil and to reduce energy The reality is, that the world oil demand is forecasted to grow in This report indicates that we expect a slow down in the years after Assumptions for this oil demand forecasts are; the Worlds Gross Domestic Product GDP grow will slow down compared towe expect normal weather and the Suresh Under the guidance of S.

Com HONS Course is based on an original and independent work 777 binary option dictionary out by D. Suresh under my guidance and supervision. Girish Faculty of Dept. Girish, Faculty of Department of Commerce, and Christ University.

I also declare that this project has been conducted in partial fulfillment of the Theory of Random Walks Predicting Stock Market Prices Essay Random Walks in Stock Market Prices FOR MANY YEARS economists, statisticians, and teach- ers of finance have been interested in developing and testing models of stock price behavior.

One important model that has evolved from this research is the theory of random walks. This theory casts serious doubt on many other methods for describing and predicting stock price behavior methods that have considerable popularity outside the academic world.

For example, we shall see later that if the random walk theory is an accurate description of reality, then the various "technical" or "chartist" procedures for pre- dicting stock prices are completely without value.

Unfortunately, however, most discussions of the theory have appeared in technical academic journals and in a form which the non-mathematician would usually find incomprehensible.

This article describes, briefly and simply, the theory of random walks and some of the important issues it raises concerning the work of market analysts. To preserve brevity some aspects of the theory and its implications are omitted. More complete and also more technical discussions of the theory of Studies of Stock Price Volatility Changes Essay Studies of Stock Price Volatility Changes Fischer Black, Massachusetts Institute of Technology This article explains the analysis of Fischer Black on the volatility of underlying shares that flow in the cash market.

Fischer Black also determines and explains how futures trading affect cash market volatility. Volatility may be described as a time series indicator which enables traders to quantify changes in market prices.

Volatility can be characterized as historical or implied. According to Fischer, volatility creates inconsistency in price trends; this results in a situation at which formulas for volatility can be changed according to the predictability of volatility. Fischer identified four factors that affect volatility.

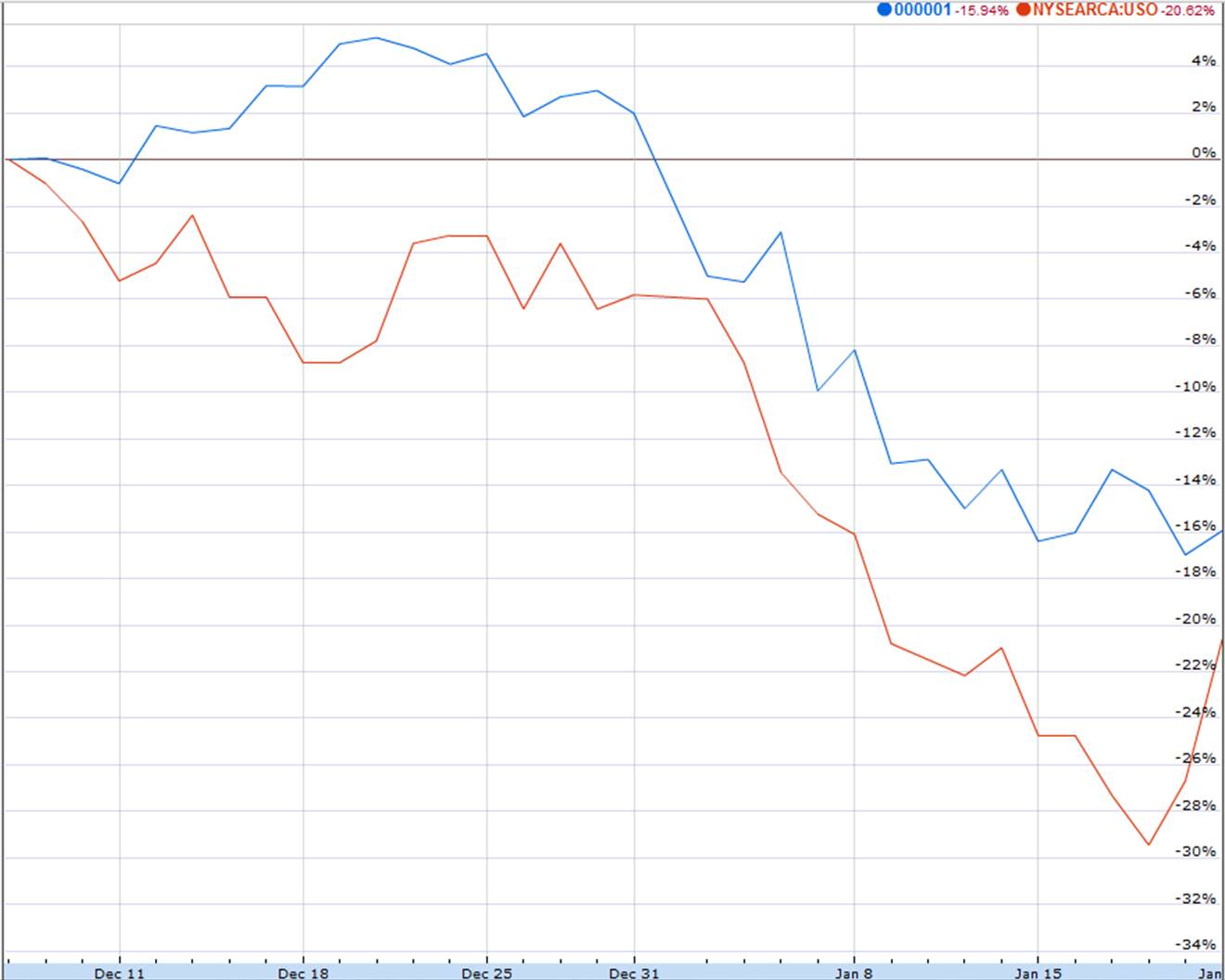

The relationship between stocks and oil prices | Brookings Institution

Essay on Impact of Gdp on Stock Market Interest Rates on Stock Prices of Quoted Companies in Nigeria Daferighe. Emmanuel E Lecturer, Department of Accounting, Faculty of Management Sciences Olabisi Onabanjo University, Ago-Iwoye, Ogun State, Nigeria E-mail: Samuel O Lecturer, Department of Accounting, Faculty of Management Sciences Olabisi Onabanjo University, Ago-Iwoye, Ogun State, Nigeria Tel: The stock prices of quoted companies in Nigeria are affected either positivity or negatively by a number of factors occurring within or without the economic system.

The paper examines the impact of Real Gross Domestic Product RGDPInterest Rate INT and Inflation Rate INF on stock prices of quoted companies in Nigeria from — A regression analysis showed that the explanatory variables accounted for While a reduction in interest and inflation rate resulted in increased stock pricesincreased RDGP has a positive impact.

Why stocks need to break free from shackles of oil - Jan. 26,

Government should therefore implement policies Please enter an email address: Join millions of other students and start your research Become a StudyMode Member SIGN UP - IT's FREE. Have a great research document you think will help inspire other StudyMode members? Share your document Upload Now. More great study tools: