Buy sell stop limit stock chart

Traditional Roth IRA Conversion RMD Beneficiary RMD How to Invest Overview Investing Basics Overview Set Your Goals Plan Your Mix Start Investing Stay on Track Find an Account that Fits Waiting Can Be Costly Saving for Retirement Overview How to Save for Retirement Retirement Savings Strategies: What's new Where are my tax forms?

You can do this in two ways:. You may send this page to up to three email addresses at a time. Multiple addresses need to be separated by commas. The body of your email will read: Sharing this page will not disclose any personal information, other than the names and email addresses you submit. Schwab provides this service as a convenience for you. By using this service, you agree to 1 use your real name and email address and 2 request that Schwab send the email only to people that you know.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. You also agree that you alone are responsible as the sender of the email. Schwab will not store or use the information you provide above for any purpose except in sending the email on your behalf. The final decision in placing a trade comes down to order type.

Learn about the uses in and differences between three of the most common kind. About to pull the trigger on a trade, but confused about which order type to use? You're not alone—an often-overlooked yet fundamental aspect of trading is selecting the appropriate order type. When placing an order, it helps to think of each order type as a different tool, each suited to its own purpose. So just as a hammer, screwdriver, or wrench may be your tool of choice for a given construction job, each order type has its own function.

Here, we'll focus on three main types of orders: A market order is an order to buy or sell a stock at the best available price. Keep in mind that a market order guarantees execution but does not guarantee a particular price. Traders should consider using a market order only when their primary concern is getting the trade done immediately. To understand how market orders work, keep in mind that a stock has both a bid price and an offer price.

Typically a trader buys a stock at the offer and sells at the bid.

Which Order to Use? Stop-Loss or Stop-Limit Order | Investopedia

The quote on a stock usually includes the last trade price, the highest bid and the lowest offer. Please note that the last trade price may not be "current"—with less-liquid stocks, the last trade may have occurred several minutes, several hours, or even longer ago.

An illiquid stock is one that typically averages fewer than , shares traded per day over the previous month. It's the current bid and offer prices that are important—not necessarily the last trade price. Note that a market order should not be placed outside of normal trading hours. If there's a news story after the market closes today or before it opens tomorrow, the market's reaction can cause a significant move in the stock price, resulting in your paying a price considerably different from what you intended.

This is known as a gap in price, and we'll cover how gaps affect Stop and Limit orders later. Just because a story seems positive or negative doesn't mean that the stock will move higher or lower. Remember that it's the market's reaction that matters, not the story itself.

A limit order is an order to buy or sell a stock at a specified price or better. It guarantees a price but doesn't guarantee execution. This is where the two basic questions above come into play. Are you buying or selling?

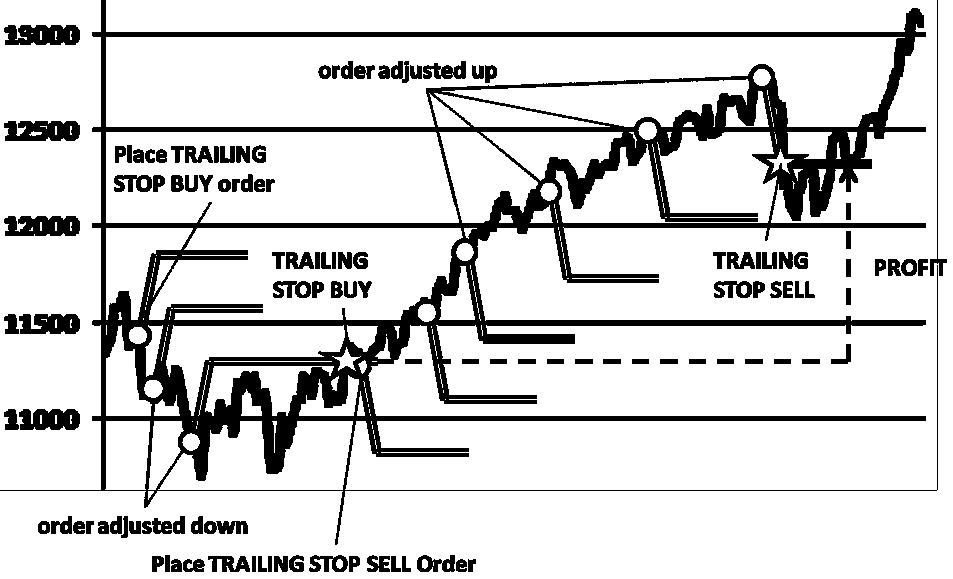

Are you most interested in the current price, a lower price, or a higher price? A limit order might make sense if:. Take a look at the chart below. It shows both market and limit orders to buy and sell for a given stock. A stop order is an order to buy or sell once the price of a stock reaches a specified price. A sell stop order is often referred to as a "stop-loss" order. In this context, you own a stock and want to try to limit the downside risk. You identify a specific price that will activate your order to sell the stock, in essence "stopping" your loss from getting worse.

So if the stock drops to that price or gaps below that price , the stop order to sell is triggered and becomes a market order executed on the next trade. However, a stop order may be used as a buy order as well. In this case, you identify a specific price that will trigger a purchase of the stock, in essence "stopping" the stock from getting away from you as it breaks to new highs at a level that may indicate a potential new uptrend.

This type of order may be useful to a trader trying to identify a point at which a stock's price trend changes from down to up. Now, let's revisit our example on the same date as above. Market and stop orders Source: Note that prices are used only to illustrate how orders may be used.

You may have heard a trader say, "I don't use stop-loss orders—they don't work because my stop was executed at a much lower price. This gap between one day's close and the next day's open is often due to a sell order imbalance. The stock market is a real-world laboratory where the law of supply and demand is demonstrated daily. If there are a large number of shares for sale relative to the number of shares to purchase, this produces a relative sell-order imbalance.

The key word here is "relative.

There must always be an equal number of shares bought and sold. While a gap down in price on a stock you own may not happen that often, it is very memorable when it does happen to you. Take a look at the next chart example. In reality, it functioned as exactly as it should, yet still produced an unexpected result—a lower price than you were expecting. Gap down resulting in a lower price Source: If a stock you own gaps lower—right through your sell-stop order—realize that whatever the news may be, it appears that the market is perceiving it as negative and that negative perception is all that matters at that moment.

The saying on Wall Street is: Your first loss is your best loss. In my experience, losses have usually hurt more than gains have felt good. A gap higher can work in your favor if you have a sell limit, in the same way a gap lower works against you with a sell-stop order, as shown in the chart below.

Gap up can work in trader's favor Source: GTC orders are valid for up to 60 days at Schwab, not forever. By definition, market orders, which request execution on the next trade, are day orders. If market orders are submitted while the market is open, they generally cannot be cancelled. Limit and stop orders may be submitted as either "Day" or "GTC" orders and may be changed or cancelled unless actually executed.

When it comes time to enter or exit a trade, remember to think in terms of two basic questions:. Then, based upon your understanding of the different types of orders, select the correct tool for the job at hand.

Important Disclosures The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Security charts shown are for illustrative purposes only and should not be construed as a recommendation or an offer to sell, or a solicitation of an offer to buy any securities. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Schwab does not recommend the use of technical analysis as a sole means of investment research.

Member SIPC All rights reserved. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice.

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its banking subsidiary, Charles Schwab Bank member FDIC and an Equal Housing Lender , provides deposit and lending services and products.

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. This site is designed for U. Learn more about our services for non-U. Unauthorized access is prohibited. Usage will be monitored. Expanded accounts panel with 5 nested items Overview Checking Account There are 1 nested list items FAQs Savings Account Home Loans There are 7 nested list items Today's Mortgage Rates Purchase a Home Refinance Your Mortgage Home Equity Line of Credit Mortgage Calculators Mortgage Process Start Your Loan Pledged Asset Line There are 1 nested list items PAL FAQs.

Find a branch Contact Us.

Stop Loss orders – Limit/Market « Z-Connect by Zerodha

You can do this in two ways: Select your online service with one of these buttons. Copy the URL in the box below to your preferred feed reader.

Forex | Forex Nedir | Klas Forex

Sharpen Your Trading Skills With Live Education Online Courses Local Workshops. Follow us on Twitter Schwab4Traders. As you consider which order type you'll need, first ask yourself two basic questions: Am I trying to buy or sell?

What price do I want—the current price, a higher price, or a lower price? Do It Now A market order is an order to buy or sell a stock at the best available price.

When You Want a Specific Price or Better A limit order is an order to buy or sell a stock at a specified price or better. A limit order might make sense if: You're buying and want a lower price, because a limit order allows you to specify a price below the current market price.

You're selling and want a higher price, because a limit order allows you to specify a price above the current market price. Market and Limit Orders Source: Stop orders and gaps in price You may have heard a trader say, "I don't use stop-loss orders—they don't work because my stop was executed at a much lower price. Limit orders and gaps in price In my experience, losses have usually hurt more than gains have felt good.

Which timeframe for which order type: Day or Good Till Cancelled GTC? Bottom line When it comes time to enter or exit a trade, remember to think in terms of two basic questions: Which price do I want—the current price, a higher price or a lower price?

Shares explained | ydigatocop.web.fc2.com

Please try again in a few minutes. Schwab has tools to help you mentally prepare for trading. Talk trading with a Schwab specialist anytime. Call M-F, 8: Get Commission-Free Online Equity and Options Trades for Two Years.

Past performance is no guarantee of future results.